Kings, Queens, and Pork & Beans —

A Curmudgeon Turns 50

KEITH BERLIN

Senior Vice President

Director of Global Fixed Income and Credit

FIXed Income in the 2000s

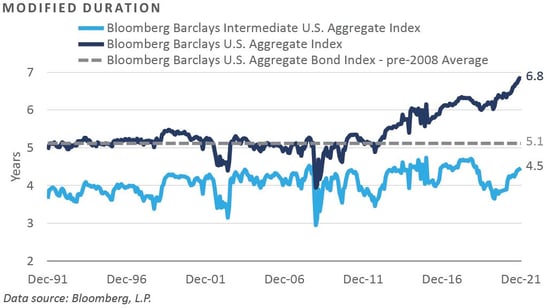

In the early 2000s, the fixed income landscape consisted primarily of clients using actively managed “core” fixed income managers who ran portfolios benchmarked to the Bloomberg Barclays U.S. Aggregate Bond Index—known to fellow curmudgeons as the “Lehman Agg” or “the Agg.” Then, as now, core managers looked to provide “alpha” primarily through sector rotation, security selection, yield curve positioning, and duration management. The effective duration, or interest rate sensitivity, of the Agg at that time was less sensitive to interest rates at around 5 years. By comparison, today the effective duration is 6.8 years. Bond “kings” past and present like Bill Gross (PIMCO), Jeffrey Gundlach (then of TCW), Larry Fink (BlackRock), and Dan Fuss (Loomis Sayles) were viewed by televised business media as rock stars, and investors hung on their every word.

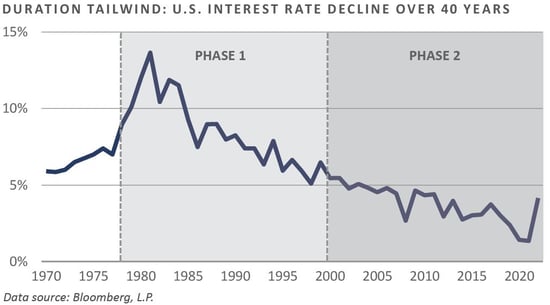

The “duration tailwind” that began with the Paul Volcker Federal Reserve (Fed) of the early 1980s was in full swing by the early 2000s (Phase 1), helping the rock stars of fixed income add alpha relative to the Agg and zeros to their bank accounts. Most investors at the time did not believe another 20+ years of duration tailwind was to come (Phase 2), which ultimately proved to be the right call. Thrill-seeking contrarians like Jim Grant from Grant’s Interest Rate Observer, pleaded for higher rates time, and again, only to remain befuddled by still-lower rates and below-trend growth.

The Great Financial Crisis and the 2010s

The Great Financial Crisis (GFC) of 2007-2008 brought a proliferation of niche credit strategies focused on taking advantage of the “distressed opportunity of a lifetime.” Both broad and niche markets were dislocated amid the forced reduction of risk-taking—eventually codified by the Volcker Rule—by systemically important financial institutions (SIFIs). SIFI balance sheets had become bloated and over-levered to sub-prime mortgages and other credit investments. Distressed kings like Howard Marks (Oaktree), John Paulson (Paulson & Co), Josh Friedman (Canyon), and Victor Khosla (SVP Global), and distressed “queens” like Maria Boyazny (then of Siguler Guff) managed funds meant to capture the breadth of the distressed opportunity, and most were largely successful.

The 2010s saw no major distressed cycle, but instead brought the “normalization” of a massive Federal Reserve Balance sheet—a balance sheet that has proven resilient to past Fed tapering efforts and still weighs on the potential growth prospects for the U.S.

While there was no major distressed cycle during the decade, there were ripples, as the 2010s also brought the first taper tantrum and a collapse of energy prices that caused bond spreads for energy issuers to reach distressed levels.

Pork & Beans

At the time of this publication, the Agg yield is below 2%, and the effective duration is closing in on 7 years, representing considerable sensitivity to U.S. interest rates. Corporate and consumer credit spreads remain tight despite the volatility experienced thus far in 2022, and the Fed has prepared market participants for the beginning of the next rate hiking cycle. With asymmetrical risk facing fixed income investors, the bond market is a tough place for a would-be bond king or distressed queen to generate meaningful alpha in a world offering pork & beans.

The Emergence of Private Debt

The world of leveraged finance and shadow banking has been around for a long time. Still, it has moved to the forefront over the past 5 to 7 years as yield-starved investors have become more comfortable with draw-down structures and the promise of larger coupons and higher yields than those offered by the public credit markets. With the Volcker Rule, regulators pushed SIFIs out of higher risk-seeking activities, leading to an environment where a large swath of companies needed to rely more heavily on non-bank lenders.

Hundreds of private lenders calling themselves “direct lenders” have come into the market over the past five to seven years. FEG saw this wave of willing lenders come to market and chose to defend ourselves and our clients from the onslaught by focusing on seasoned leveraged finance professionals who had inadvertently fallen under the new direct lending umbrella. While FEG continues to be an advocate of private debt as an asset class and remains highly selective in our partners, this curmudgeon admittedly raised a salty eyebrow after recently receiving a new direct lending presentation book from the asset management arm of one of the largest banks in the U.S.

2021 Fixed Income Recap

Coming off back-to-back monster years for the Agg—with returns of 8.7% in 2019 and 7% in 2020, respectively—FEG anticipated further fixed income gains would be difficult to come by in 2021. Indeed, the Agg lost 1.5% in 2021 as interest rates rose throughout the year, marking only the fourth negative calendar year on record since its inception in 1976. Corporate and consumer credit produced “coupon clip” returns for the year in the mid-single digits, withstanding the pressure of higher interest rates. In FEG’s 2021 outlook, we recommended clients consider reducing duration in portfolios by swapping from core fixed income to an intermediate duration mandate. With the Bloomberg Barclays Intermediate Aggregate Bond Index (IAgg) declining by 0.9% in 2021, the proposed shift benefited investors by offering a loss ~60 bps less than the former core fixed income mandate. Pork & beans indeed.

FEG also suggested investors consider asking their active fixed income managers for lower fees on their accounts due to low yields, as well as consider passive options to save money. If Benjamin Franklin was an investor, he might have noted that in years like 2021, a basis point saved was a basis point earned. The structured credit markets remained dislocated at the beginning of 2021, and the managers we follow generated positive absolute returns for the year. Riskier tranches of structured credit generally outperformed higher quality tranches throughout the year, generating mid to high single-digit returns. We also noted the illiquidity premium had returned for private lending strategies and suggested considering alternative credit strategies to find unique sources of alpha—or at least positive returns.

The 2022 Fixed Income Outlook

Typically, FEG’s annual outlook focuses on the year ahead as a whole and does not give market action in January undue attention. That will not be the case this year, however, as interest rate volatility ruled the first month of 2022 amid a much more hawkish Fed than we saw in the back half of 2021. The Fed is now promising three interest rate hikes in 2022, and the market is anticipating four, all with a pace expected to be much quicker than forecast in late 2021. The 10-year U.S. Treasury rose from 1.54% at the end of 2021 to 1.90% at its January peak. Due primarily to the high degree of interest rate sensitivity found in the Agg, the benchmark lost 2.2% in January. This 1-month decline represents more than the Agg’s entire yield (1.7%) coming into the new year. Thankfully, 11 months remain in 2022 to make up the loss, but it will take more than just coupon payments to end the year with a positive return. With the markets in a state of transition, the remainder of 2022 is likely to keep investors on their toes. The following fixed income outlook is a brief look at where we stand on key areas of interest for fixed income investors today, focusing on interest rates, corporate and consumer credit, and private debt.

U.S. Interest Rates

On the U.S. interest rate side, the yield on the 10-year U.S. Treasury has increased by ~25 bps thus far in 2022, with many investors expecting a flatter yield curve. Specifically, the short end of the yield curve is expected to rise in conjunction with coming Fed rate hikes, and the long end of the curve is expected to factor in slower future growth without the benefits of further monetary or fiscal stimulus. While FEG does not make interest rate calls, the low level of absolute yield forces risk to remain skewed toward higher interest rates in the near term. The intermediate to longer-term outlook is a different story, however, we believe low levels of interest rates appear more likely due primarily to the high level of indebtedness and demographic challenges plaguing the U.S. While difficult to handicap, this curmudgeon would not be surprised if the Fed pushed short-term rates above the intermediate- and long-term rates at some point in this hiking cycle. The talk would then shift to an inverted yield curve, and former Fed chair Alan Greenspan’s “conundrum 2”—where rate hikes fail to push up rates on the long end of the yield curve—could come to pass, which would set the table for the next U.S. recession.

Shorter Duration Profiles

With option-adjusted spreads (OAS) for investment-grade corporate bonds back to pre-2020 levels—roughly 90 basis points over Treasuries—and agency residential mortgages (RMBS) benefiting from less refinancing risk given the low starting point in interest rates, FEG believes the concept of swapping to an IAgg strategy from an Agg version continues to have merit. Indeed, the divergence in the effective durations of the IAgg versus the Agg has grown considerably over the past decade, with the IAgg maintaining a more moderate effective duration much more comparable to the Agg of the past. Investors are not getting compensated for holding the increased interest rate risk of the Agg when considering the small haircut to the yield the IAgg offers. To wit, the IAgg had only 67% of the effective duration of the Agg—4.5 years versus 6.8 years—but captured ~90% of the Agg’s yield as of December 31, 2021. With tight OAS for investment-grade spread sectors and active managers’ historical lack of willingness to make big interest-rate bets, we believe bond kings will find it challenging to add meaningful value versus either benchmark.

Corporate Credit

As a proxy for the corporate credit markets, the Bloomberg Barclays High Yield Index offers a pork & beans cocktail of low coupons, low yields, tight OAS, a distressed ratio—i.e., bonds with spreads of 1,000 basis points or more over Treasuries—of 1.4%, and prices well above par at ~$103. The question on everyone’s mind is: Will the bond kings rule the day in 2022 and clip their low coupons, or will the distressed kings and queens have their day in the sun? With the Fed shifting gears, it is our view that history favors distressed investors once the cycle turns. However, as the public credit markets remain wide open and corporate issuers are smartly terming out their debt at low levels, the opportunity for distressed may take a while longer.

Consumer Credit

On the consumer credit side—which includes asset-backed securities (ABS) such as commercial mortgage-backed securities (CMBS), non-agency RMBS, and structured investments with other acronyms—spreads remain generally wider than comparable below-investment-grade corporate credit risk. Still, yields have come down versus 2021 due to the strength of the recovery. Broadly speaking, consumer credit strategies returned mid- to high-single digits, depending on security type, strategy, and the amount of leverage used by the manager—higher returns were most typically seen in less liquid fund structures, where the use of leverage is more prevalent. All things equal, FEG still likes consumer credit versus corporate credit, with the lack of interest rate sensitivity remaining a prominent feature versus other options.

Private Debt

The 2021 outlook also referenced the steep illiquidity premium for investors willing to lock up their capital in the private debt markets had returned. The private debt landscape remains full of lenders focusing on nuanced strategies that generally provide comparable returns. On average, private lenders lock up investor capital for a 3- to 4-year investment period, calling money down to fund loans made to non-banked, middle-market companies—strategies may target upper, middle, lower, and micro markets. Companies are either supported by private equity sponsors or family-run businesses without sponsors. Strategies may be levered up to the investor’s comfort level, but typically no more than 2 to 1. FEG continues to support this area of opportunity and remains focused on investing with seasoned teams with established track records over multiple cycles.

Conclusion

With the Fed shifting its policy stance from highly accommodative to ultimately removing accommodation, FEG expects continued volatility in the public bond markets, which will likely prove to be a challenge for bond kings to add alpha. We believe investors should continue to help themselves balance the asymmetrical headwinds facing portfolios today by reducing interest rate exposure and fees where they can. Shorter duration, higher-yielding corporate and consumer credit strategies can help investors get the highest quality of baked beans—which, based on a recent study, happen to be Bush’s Best Original.1 In addition, private debt remains a place to capture a meaningful illiquidity premium, and investors should select seasoned, experienced teams.

One last point: curmudgeons are not always negative, but they are always highly skeptical. As legendary American writer, Mark Twain might say, “history does not repeat itself, but it often rhymes.” While inflation and higher interest rates are the talk of the day, a Fed trying to remove its accommodative punch bowl is nothing new. If they remove it too fast and ultimately invert the yield curve, the seeds of the next recession could be sewn, and the kings and queens of distressed may be called into action. We have seen this game before, we know how it ends, and it is typically in tears.

FOOTNOTES

¹ https://www.eatthis.com/best-worst-canned-baked-beans/

DISCLOSURES

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

Published February 2022