The Beautiful Game: Investing to Win

FEG welcomed nearly 450 attendees to the tenth Investment Forum, The Beautiful Game: Investing to Win. Held in downtown Cincinnati, the forum featured 57 speakers, 12 breakout sessions, and many networking opportunities. The event's key themes included components vital to soccer—which soccer legend Pelé once called “The Beautiful Game”—and institutional investing: bringing the community together, following a clear game plan, and navigating unpredictability.

A Welcome from CEO Becky Wood, Incoming CEO Alan Lenahan, and Incoming President Bill Goslee

President and CEO Becky Wood opened FEG's tenth Investment Forum by extending a warm welcome to all attendees and providing an update on changes in the firm since the last forum in September 2019. Addressing the forum theme, "The Beautiful Game: Investing to Win," Becky drew parallels between the world of investment advisory and the famous saying by Brazilian soccer player Pelé, highlighting the importance of teamwork and patience. Becky’s experience at FEG over the past 31 years served as a backdrop to her reflections on the evolution of the industry, and she shared three enduring lessons she has gleaned throughout her career.

Becky's Career Lessons

- Markets are up more than they are down. The duration of the up markets is much longer.

- Have a game plan. It helps to keep your emotions in check when the markets move significantly up or down.

- Investing is hard… and rewarding.

Following her lessons, Becky was joined on stage by Incoming CEO Alan Lenahan and Incoming President Bill Goslee—both of whom will take over on January 1, 2024, following Becky’s retirement. They discussed the value of long-term planning, the significance of partnership and alignment, and FEG's commitment to reinvestment and independence.

|

| Becky Wood, Alan Lenahan, and Bill Goslee discussing FEG's commitment to clients. |

Long-Term Planning and Resilience

Since Becky joined the company in 1992, FEG’s assets under advisement (AUA) have grown from $1 billion to more than $75 billion.1 Underscoring the importance of long-term investment plans, she emphasized that while markets experience fluctuations, the duration of upward market trends is typically more substantial.

A structured game plan helps mitigate the influence of emotions and human behavior during market downturns. Investing, Becky asserted, is a challenging yet rewarding endeavor, echoing Pelé's wisdom that "success is no accident."

"Success is no accident. It is hard work, perseverance, learning, studying, sacrifice, and most of all, love of what you are doing or learning to do."

— Pelé, Brazilian Footballer

Partnership and Alignment

Along with Alan and Bill, Becky drew parallels between soccer, the ultimate team game, and the collaborative nature of the client-advisor relationship at FEG. A collegiate soccer player in his past life, Alan stressed that alignment is the key to success—both on the soccer pitch and in the investment world. He explained that FEG's focus on partnership extends from supporting clients' investment goals to providing excellent investment results. FEG acts as an extension of a client's team and staff, fostering a collaborative atmosphere that enhances outcomes.

FEG's Commitment to Reinvestment and Independence

Together, Becky, Alan, and Bill elaborated on FEG's strategic direction, emphasizing the firm's financial and cultural strength. They explained that FEG's reinvestment in the business is channeled into two core areas: people and technology. Investments in operations, compliance, technology, and investment teams have enabled the firm to better serve clients' evolving needs. Furthermore, FEG’s transition to an employee stock ownership plan (ESOP) structure six years ago, in which 100% of employees own 100% of the company, underscores the firm’s commitment to remaining independent. This structure strengthens alignment within the firm and reinforces its dedication to achieving clients' objectives.

As the welcome session came to a close, Bill gave a heartfelt thank you to Becky for her contributions and dedication to clients and FEG over the last 31 years. His comments were received by the audience with gratitude and applause.

1As of June 30, 2023. Assets under Advisement (AUA) include discretionary and non-discretionary assets of FEG and its affiliated entities. These assets are typically non-discretionary. Some asset values may not be readily available at the most recent quarter-end; therefore, the previous quarter's values were used and may be higher or lower depending on current market conditions. Of the $75.0bn in AUA, FEG's total assets under management (AUM) of $13.0bn includes discretionary ($11.2bn) and non-discretionary AUM ($1.8bn).

FEG Investment Outlook

Presented by Greg Dowling, CIO and Head of Research at FEG and Nolan Bean, CIO and Head of Portfolio Management at FEG.

|

| Greg Dowling delves into the current market. |

Greg Dowling shared insights into the current market environment, which has undergone significant transformations since FEG’s inaugural Investment Forum in 2009. Additionally, Nolan Bean discussed the implications of this evolving landscape on portfolio asset allocation. Their investment outlook included an overview of the changing dynamics of interest rates and inflation, the potential impact of artificial intelligence (AI) as the next technological revolution, and the mission-focused portfolio asset allocation model.

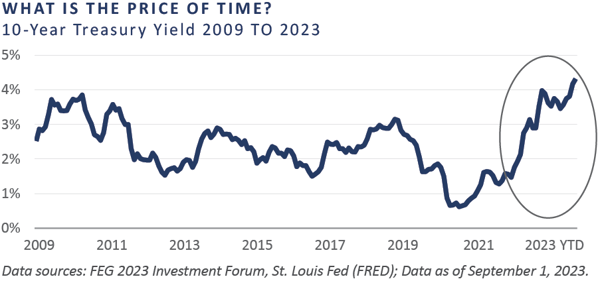

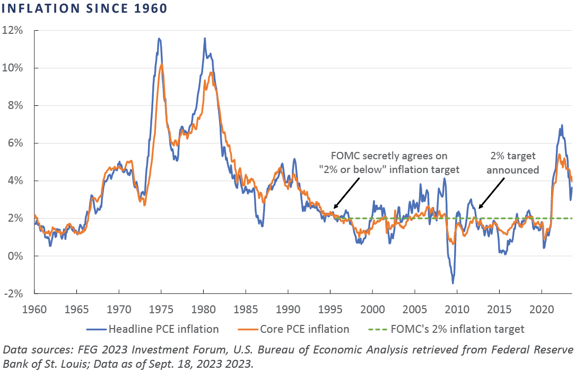

Shifting Interest Rates and Inflation

Greg started by reviewing the drastic changes in the market compared to previous forums, observing that FEG's first forum took place in the aftermath of the Global Financial Crisis (GFC). The subsequent years saw one of the longest bull markets in history, marked by abundant liquidity and technology innovation until finally being interrupted by COVID-19.

Greg delved into the impact of interest rates, which remained near zero from 2009 to 2022, prompting the "there is no alternative" (TINA) narrative. However, he noted that cash has now become a viable alternative. He provided an overview of the history of interest rates and the challenges posed by quantitative tightening, potentially leading to a less liquid environment. Additionally, he addressed the rise in inflation driven by fiscal stimulation during the COVID-19 pandemic, highlighting the potential for a recession and emphasizing the need to monitor inflation closely.

AI as a Major Tech Revolution

Next, Greg discussed the second trend FEG is considering: “Is AI the next major tech revolution?” He shared that AI has been found everywhere; it was even used to create the image for the FEG Forum.

The question for investors is to understand the right price. Greg challenged the audience to consider the appropriate valuation of AI, recognizing its transformative potential across various sectors. NVIDIA—a company at the forefront of AI technology—was highlighted for the recent ascent of its stock, which reached incredible valuations but also saw a tremendous surge in revenue, illustrating the growing importance of AI.

Portfolio Asset Allocation Considerations

|

| Nolan Bean emphasizes asset allocation considerations given evolving interest rates and market dynamics. |

They may be scary and messy in the short term, but they will work well in the long run,” he assured. Nolan emphasized four key considerations for strategic asset allocation.

|

FOUR STRATEGIC AA CONSIDERATIONS |

|

Source: FEG 2023 Investment Forum. |

Mission Focused: Start with risk, not return. In this section, Nolan highlighted the importance of starting with risk in mind, not return. Investors should embrace risk in the long term and understand their tolerance levels within enterprise risk, market risk, illiquidity risk, and maverick risk.

The Fed/Inflation: FEG’s investment team believes it will likely take a long time for rates to return to the Fed target of 2%. Looking at historical data, inflation took an average of 14 years to return to more temperate levels after reaching its peak. Because of this, there is the potential for profitable bond investments amid higher rates.

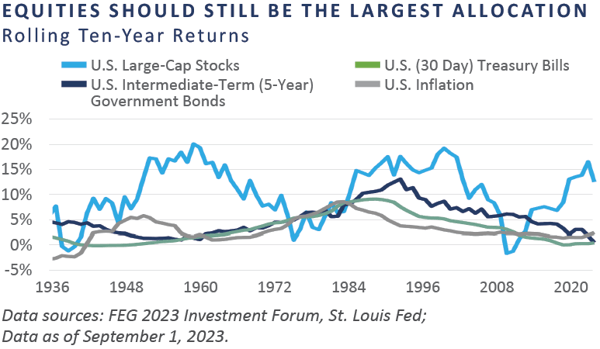

Equity Markets: While bonds may have a place, FEG recommends that equities remain the largest allocation.

Private Markets: Even though private markets have a significant amount of dry powder, FEG believes there is still an opportunity, or as Nolan phrased it, “embrace as much as you can.” To emphasize the opportunity, he shared that the number of privately held companies with revenue over $10 million is 45 times that of publicly traded companies.

FEG’s INSIGHT

In their presentation on the dynamic market environment, Greg Dowling and Nolan Bean explored the challenges posed by evolving interest rates and inflation, the transformative potential of AI, and the considerations essential for effective portfolio asset allocation. These insights help provide a framework for investors to navigate and adapt to the ever-changing landscape of financial markets, ensuring their investment strategies remain positioned to take advantage of current and emerging trends.

The Invisible Power of Market Narratives and How AI Lets Us See Them

Presented by Ben Hunt, Chief Investment Officer at Second Foundation Partners and author of Epsilon Theory.

|

| Ben Hunt discusses the power of subconscious narratives. |

Ben Hunt explored the intricate interplay between narratives, human perception, and AI. He explained the power of narratives, the evolving media landscape, and the transformative potential of AI. His insights offered a unique perspective on how narratives shape our understanding of the world and the role of AI in dissecting these narratives.

The Significance of Narratives

Ben underscored the fundamental role of narratives in human cognition. He explained that narratives often operate subconsciously, helping individuals make sense of the world around them. Drawing parallels to Hollywood's perfected narrative archetypes, Ben explained how these stories serve as templates for our understanding of cultural norms. He then introduced the concept of "Gell-Mann Amnesia," in which individuals tend to overlook the patterns within the stories they are immersed in, emphasizing our biological inclination to accept narratives without critical examination. Ben argued that narratives are wielded as potent tools for various purposes, including accumulating wealth, garnering ratings, securing votes, and boosting engagement.

The Impact of Social Media and Smartphones

Ben then discussed the transformation of communication in the digital age. With the advent of social media, human interaction has shifted from one-to-one to one-to-many conversations, altering the dynamics of narrative dissemination. Media organizations have evolved into 24/7 entities, with a significant portion of news now comprised of pundits’ opinions presented as news. Smartphones have played a pivotal role in this shift by fostering constant communication and enabling machines to engage with users. Ben asserted that individuals have begun developing tools to discern the underlying stories behind the information they encounter, reflecting the evolving nature of media consumption.

|

NARRATIVE ARCHETYPES OF THE TRAPPED BUTTERFLY |

|

|

Source: FEG 2023 Investment Forum. © Lee Steffen steffenstudio.com |

Machine Intelligence and AI

Next, Ben provided insights into the stark differences between human and machine intelligence—particularly AI. He explained that AI excels at perceiving intricate data connections and operates as a network that views the world as another, more extensive network, contrasting with the perspective provided by the human brain. AI functions like a compound eye, designed to swiftly detect minute changes and motion. Its immediate data retrieval capabilities and vast recall make it adept at processing information. Ben further pointed out that AI evaluates vast amounts of unstructured text, comparing every word to every other word, enabling it to uncover patterns and connections that human intelligence might overlook.

|

AI IS A COMPOUND EYE |

|

|

Similar to the insect's compound eye, AI is designed to swiftly detect minute changes and motion enabling it to uncover patterns and connections that human intelligence might overlook. |

FEG’s INSIGHT

Ben Hunt's presentation explored the symbiotic relationship between narratives, human cognition, and AI. His insights underscore the potency of narratives in shaping our understanding of the world and the transformative potential of AI in dissecting and comprehending these narratives. FEG believes that as AI continues to evolve in the digital age, the use and benefits of the technology will likely have both ups and downs and, over the long term, become increasingly pivotal in influencing economic activity.

A View from Washington

Presented by Libby Cantrill, Managing Director and Head of U.S. Public Policy at PIMCO.

|

| Libby Cantrill unpacks the political landscape. |

Libby Cantrill led the audience through a fascinating discussion on the debt ceiling deal, government shutdown prospects, fiscal policy, and the 2024 elections. The audience leaned in to learn more about the significant implications for the U.S. economy and political landscape.

She began by discussing the debt ceiling, a critical focus in financial markets recently resolved without significant incident. In June, Congress passed an agreement to raise the debt ceiling until January 1, 2025, with the practical ability to extend it further. This move alleviates macroeconomic tail risks until at least mid-2025. However, this resolution also includes a mandate to resume student loan payments, impacting approximately 40 million borrowers. While the potential government shutdown may seem relatively uneventful, concerns remain about potential prolonged and nonlinear economic effects. Furthermore, a shutdown could disrupt vital economic data, complicating decisions of the Fed at upcoming meetings.

Libby explained that the focus in Washington is shifting toward fiscal austerity, driven by rising interest expenses and projected increases in debt. Both parties and the electorate are growing more concerned about the fiscal deficit; however, there is a disconnect between this focus and the actual budget. Most of the debt growth over the next 30 years is projected to come from entitlement programs, as non-discretionary outlays vastly exceed discretionary spending. Despite concerns, the U.S. dollar will likely remain the world's reserve currency for the near future.

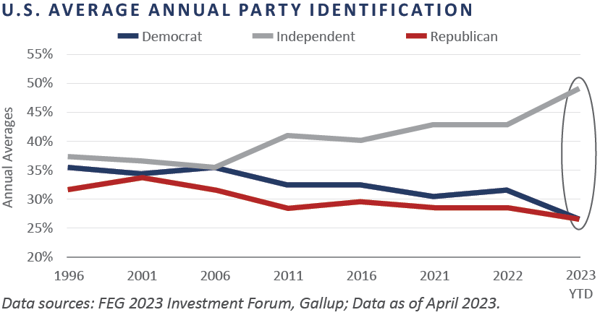

Libby also discussed the looming 2024 election, and early polling shows uncertainty and dissatisfaction with both major parties. As such, there is a possibility a third-party candidate could impact the election's outcome, particularly in swing states. The election is expected to come down to critical states such as Georgia, Nevada, Wisconsin, Michigan, Arizona, and Pennsylvania. Social issues, including inflation and abortion, will likely play a significant role in shaping the electorate's choices. Early head-to-head polling is considered unreliable, and dynamics can quickly shift as the election moves closer. For example, Libby pointed to the Trump Campaign’s tactical moves behind the scenes, lobbying states to switch from proportional delegate allocations in which multiple candidates can win delegates in a state to a winner-takes-all approach. This subtle change, not discussed broadly in the press, clearly benefits the frontrunner.

FEG’s INSIGHT

Uncertainties abound as the U.S. navigates complex economic and political challenges, including the debt ceiling, government shutdown, fiscal policy, and the 2024 elections. Resolving these issues will have far-reaching consequences for the economy and the political landscape. While some short-term clarity has emerged regarding the debt ceiling, the longer-term implications of fiscal policy and the election remain uncertain, making monitoring developments closely in the coming months and years crucial.

CIO Corner: A Discussion With Nonprofit CIOs

Presented by McCall Cravens, CIO of the Heinz Family Office; Anders Hall, Vice Chancellor for Investments and CIO of Vanderbilt

University; Robert Durden, CEO and CIO of UVIMCO; and Ted Seides, host of Capital Allocators.

Ted Seides, Anders Hall, Robert Durden, and McCall Cravens explore asset allocation, current views on private capital, investing in China, and hidden risks and opportunities in today's markets. |

Ted Seides moderated a captivating panel discussion among CIOs from highly regarded institutions on asset allocation, current views on private capital, investing in China, and hidden risks and opportunities in today’s markets.

Ted opened the conversation by asking the panelists about asset allocation within privates. Anders shared that he has seen its allocation to private investments rise substantially from the target of 35% to 47% due to a decline in public markets in 2022 and the deceleration of distributions from private equity funds. He further explained that until recently the shift has been driven by the strong relative performance of private equity, which had displaced public equity in their portfolios. McCall pointed out that, just like during the Great Financial Crisis (GFC), it is best to take a long-term perspective on private allocations and continue to allocate to the space. Despite high allocations to private assets, Anders emphasized the importance of setting clear standards for recommitting to existing General Partners (GPs) and engaging with new ones. He commented that the fear of missing out on favorable vintage opportunities drives continued commitments, even as they become a more significant portion of the portfolio. All panelists agreed it is important to carefully assess which opportunities are compelling and reject those that fail to meet an institution’s standards.

The conversation then shifted to a high-profile topic: investing in China. Anders noted he has never seen market sentiment change so quickly, stating that the new consensus view is that China will be a challenging place to invest. The panelists explained that private capital allocations in China have been materially lower in recent years, with less meaningful changes to public exposures. Anders pointed toward the “jump to zero” risk seen in 2022 with Russian investments, adding that private allocations in China are less palatable relative to liquid exposures. While discussing the broader geopolitical landscape, Robert questioned whether China is uninvestable. He recalled a conversation he had with a Latin American-focused manager in which he asked about recent local elections.

The manager retorted that he was not concerned about the highly contentious elections in the region but with the upcoming U.S. presidential election. Robert concluded that this viewpoint is shared with investors outside the U.S., and giving consideration to other perspectives can help frame one’s understanding of the broader geo-political landscape.

Next, Ted posed a thought-provoking question to the panelists: “What risks or opportunities is nobody discussing?” McCall responded that cross-asset correlations have shifted positively, challenging the traditional assumption that bonds protect portfolios during equity downturns. Anders shared that he has been considering diversifiers like commodities and insurance-linked bonds, which have historically shown uncorrelated performance with equities. All panelists acknowledged that the role of bonds in protecting against inflation may be less effective in a higher inflation environment. Robert offered the viewpoint that demographics and high levels of government debt will prove to be disinflationary while short-term inflation risks remain.

During the question-and-answer part of the session, the panel discussed the concept of over-diversification in investment strategies, particularly in the context of portfolio management. Panelists were critical of over-diversification, in which allocation sizes for public investments are spread thinly across many managers, leading to hyper-diversification. The panel advised investors to consider factor diversification rather than the number of managers within a portfolio. They also touched on the challenges of negotiating investment terms with asset managers, noting limited success in achieving significant changes. When asked about co-investment programs, Anders observed that co-investments are a strategy to leverage managers’ high conviction exposures while reducing fees. Robert’s sentiments were similar. McCall favored a more cautious approach due to a smaller investment staff and a preference for cash-flowing businesses over venture and growth equity investments.

FEG’s INSIGHT

FEG’s Advisory Board supports the company’s growth and development by bolstering the company’s depth of institutional knowledge. The advisory board adds their industry insight to the firm’s established portfolio management, operations, and research teams. The board meets four times a year and is led by FEG Head of Institutional Investments, Nolan Bean.

Power of Sports

Part one presented by Jeff Smith and Corben Bone from FC Cincinnati (FCC). Part two presented by Kara Nortman, Founder of Angel City Football Club and Managing Partner of the Monarch Collective; and Ian Charles, Founder and Managing Partner of Arctos Sports Partners.

In this discussion, leaders from the world of sports and entertainment shared their experiences and insights. Topics included building a successful sports franchise, investment opportunities in the sports industry, the potential for women's sports, the role of media in sports, and the magic of “the beautiful game” known as soccer. Two members of FC Cincinnati shared the club’s incredible story of going from a concept formed at a local soccer bar to an established professional team in record time.

|

| Corben Bone and Jeff Smith share the history of FCC. |

Jeff Smith, FCC’s second employee, shared the journey of starting the team from scratch. What began as an idea among friends at a local Cincinnati soccer bar quickly gained momentum as the group engaged with the community. Their focus on affordability, family-friendliness, community involvement, and a winning brand helped sell the dream of professional soccer to the public. Just 277 days after the club was founded, it joined the Major League, highlighting the group’s commitment to building with and for the fans. Corben Bone then talked about coming out of retirement to join FCC’s first roster. He recalled the electric energy of Nippert Stadium during the team’s inaugural season and the collective drive of the organization to become an established team in Major League Soccer.

|

| Kara Nortman and Ian Charles share insights on sports investing. |

Following Jeff and Corben, Kara Nortman shared her journey into owning and investing in women's sports. Kara explained her passion for addressing the inefficiencies in women's sports and the need for greater diversity in ownership and equal pay in the industry. Kara’s passion led her to start Angel City Football Club, the world's most valuable women's soccer franchise. Angel City FC’s journey was captured in the HBO Original series Angel City. Following the success of Angel City FC, Kara created Monarch Collective, a private capital firm that invests in women’s sports teams and leagues, combining Kara’s passion for women's sports and investing.

Joining Kara on stage, Ian Charles discussed the unique opportunities available in sports investment. His company, Arctos Sports Partners, specializes in providing liquidity to premium sports owners in North America. Ian emphasized the importance of having the opportunity to own not just a sports club but also a share of the sports league's global intellectual property (IP). While serving as an investment committee member of Landmark Partners, a leading private capital secondaries firm, Ian was instrumental in conducting secondary market liquidity transactions. He identified minority equity investors in sports franchises as a growing, fragmented, and highly inefficient market. He explained that the sports industry is often misunderstood and, therefore, has significant potential for growth and uncorrelated returns. Moreover, he noted that the ability to influence team decisions and access the tax benefits of ownership make it an attractive area for investment.

FEG’s INSIGHT

This discussion provided valuable insights into the world of sports and entertainment, from building a soccer franchise with community engagement at its core to exploring investment opportunities in sports ownership. It also shed light on women's sports, the power of sports content, and the changing landscape of college athletics. The discussion highlighted the significance of sports content in the media landscape. Sports offer a unique communal and authentic experience in a world dominated by personalized content. Live sports is the only content people watch together, creating a sense of unity and authenticity. The value of live sports content is further amplified by its potential for monetization through new media streams and sports betting. As the sports industry continues to evolve, it offers both challenges and opportunities for investors, entrepreneurs, and fans alike.

Fireside Chat with Mellody Hobson

Presented by Mellody Hobson, President and Co-CEO of Ariel Investments.

|

|

Mellody Hobson highlights the importance of values, long-term patient investing, and diversity in investment management. |

Alan Lenahan sat down with Mellody Hobson, who highlighted the importance of values, long-term patient investing, and diversity in investment management. Mellody, who started her journey at Ariel at the age of 19 as an intern, shared her experiences and the wisdom she has gained over the years.

Values and Alignment

A central theme of the discussion was the significance of values in building a successful organization. Mellody emphasized that Ariel Investments became her lifelong career choice because the firm valued her ideas and work ethic. She stressed the importance of clarity regarding an organization's values and how they serve as a foundation for building alignment among team members. At Ariel, alignment is achieved by adhering to the firm's core values of Active Patience®, Independent Thinking, Focused Expertise, and Bold Teamwork.

"You need to be very clear about your values. If you understand what your values are

and get a common understanding amongst people, then you can scale growth. You must be very clear: What do you stand for? What do you believe? And then try to find people who are like-minded that won’t just fall in line because you want to be challenged.”

— Mellody Hobson

Long-Term Patient Investing

Mellody shared that she and John Rogers, Jr., Founder of Ariel Investments, emphasize the concept of long-term, patient investing as a key strategy at Ariel. They assert that patience combined with active engagement are essential for outperforming others in the market. Their approach involves buying undervalued businesses, both domestically and internationally, and holding them for extended periods. This strategy aims to capitalize on opportunities created by the market's focus on short-term gains. Mellody stressed that although patience can be challenging, it is essential for long-term success.

Diversity and Inclusion

Mellody spoke passionately about the importance of diversity in investment management. Ariel boasts an executive leadership team that is 70% women and minorities, a number that rises to 75% across the firm's employees. Mellody stressed the importance of seeing diversity at the top of an organization to encourage diversity throughout a firm. She also highlighted the role of incentives, suggesting that companies need to align compensation with diversity goals if they want to drive meaningful change. Finally, she pointed out that Ariel's success in fostering diversity has served as a competitive advantage in the firm’s recruitment and retention efforts.

FEG’s INSIGHT

In her conversation with Alan Lenahan, Mellody Hobson provided invaluable insights into the world of investment management. She underscored the importance of values in building alignment within an organization, the benefits of long-term investing patience, and the critical role of diversity and inclusion in fostering success. Ariel Investments' journey is a compelling example of how these principles can lead to resilience, growth, and excellence in the face of adversity.

Monetary Policy

Presented by Jeffrey Lacker, former Richmond Federal Reserve President.

|

| Jeffrey Lacker offers a comprehensive overview of the current state of monetary policy. |

In this discussion, the former Richmond Federal Reserve President Jeffrey Lacker—an economist by trade with a deep interest in economics and a connection to Cincinnati—shared his insights on the state of monetary policy. He explored historical parallels to previous hiking cycles, the impact of inflation on policy, and tools used by policymakers to gauge the direction of monetary policy.

Jeffrey opened the discussion by reminiscing about visiting his cousins in Cincinnati as a child and opening packs of baseball cards. He soon realized that the packs sold in Cincinnati had disproportionately fewer Cincinnati Reds players than in other markets, incentivizing card collectors to purchase more packs, thus teaching the aspiring economist about the power of incentives.

Jeffrey then reflected on the historical parallels of inflationary periods, highlighting the importance of controlling inflation, especially in past inflation spikes during the 1970s and early 1980s, when inflationary pressures returned after the initial spike.

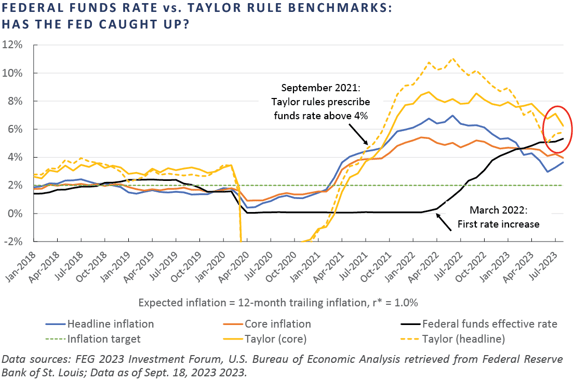

To gauge the direction of monetary policy, Jeffrey emphasized the importance of considering real interest rates, which are adjusted for inflation. He explained how policymakers use the real federal funds rate and the difference between the nominal and expected inflation rates. He also pointed out that a higher real interest rate incentivizes saving over immediate consumption, which can help reduce inflationary pressures.

To further the discussion, Jeffrey introduced the Taylor Rule, a widely accepted benchmark for gauging the appropriateness of monetary policy. This rule is an algebraic expression that relates the federal funds rate to inflation and unemployment. Following the Taylor Rule, policymakers can determine whether monetary policy is too loose or tight based on the observed economic conditions. The rule implies the Federal Funds Rate should have risen at a much brisker pace in 2021 and 2022 than the path that played out.

As he continued, he provided insights into the current state of monetary policy, highlighting recent trends in real interest rates and inflation. He shared various scenarios, including where wages and inflation decline, one where inflation remains stubbornly high, and another where inflation accelerates. He also addressed the potential for labor market shocks and how the Federal Reserve might respond.

FEG’s INSIGHT

This session provided valuable insights into the complexities of monetary policy, focusing on historical context, tools for analysis, and the challenges policymakers face in addressing inflation and economic stability. Jeffrey Lacker shared his deep understanding of economics, which, combined with his experiences in the field, offers a comprehensive overview of the current state of monetary policy and potential future scenarios.

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.