Women in Investing

To start the day, FEG hosted a Women in Investing session featuring Libby Cantrill, CFA, managing director and head of public policy at PIMCO, and Becky Wood, CEO of FEG, which was moderated by Cheryl Barker, VP at FEG. Cheryl asked Becky and Libby questions on topics ranging from their advice to women in investing to the biggest changes they’ve seen in investing since the beginning of their career. The session ended with an opportunity for attendees to network with one another and make new connections.

Washington Policy Landscape and Political Outlook

Greg Dowling, CIO and head of research at FEG kicked off the first session by introducing Libby Cantrill, CFA, managing director and head of public policy at PIMCO, who previously joined Greg Dowling as a guest on the FEG Insight Bridge podcast prior to the 2020 election.

At the outset, Ms. Cantrill reminded the audience that it is our job as investors—FEG and PIMCO included—to consider the policy landscape by separating signal from noise and understand what is likely to happen rather than assert what we believe should happen. Ms. Cantrill then took the opportunity to reflect on the positives of the Biden presidency thus far, including robust economic growth, falling unemployment, and declining child poverty rates. She also pointed out some of the challenges of the administration, notably the rising specter of inflation, Biden’s sharp disapproval ratings, and the lack of unanimity among Democrats.

She observed that the road ahead for the Biden administration and incumbent congressmen and women should prove challenging, as Democrats hold the narrowest majority since the nineteenth century when President Grover Cleveland held office. With Biden’s approval rating falling below 50%, Democrats are likely to lose major footholds in the 2022 midterms. However, it is expected that Democrats will push forward with campaign promises of the much ballyhooed Build Back Better agenda, albeit in a much skinnier form than what was originally proposed; she expects that if such a bill comes together (September is the deadline), it will focus on renewable tax credits for green energy (e.g., solar, wind), pharmaceutical drug pricing reform, along with some minor tax increases, albeit nothing notable on the personal side.

| "USICA is the closest to an industrial policy that we've seen policymakers support in decades." |

| − Libby Cantrill |

The one thing policymakers on both sides of the aisle have been able to agree on, asserted Ms. Cantrill, is the need for U.S. manufacturing independence from China. In 2021, the Senate passed the United States Innovation and Competition Act (USICA), a $250 billion bill to promote the research, development, and manufacturing of advanced technologies in the U.S. Ms. Cantrill pointed out that while this is the first bill dedicated to supporting U.S. manufacturing in decades, it’s a stance to be expected from policymakers for the foreseeable future.

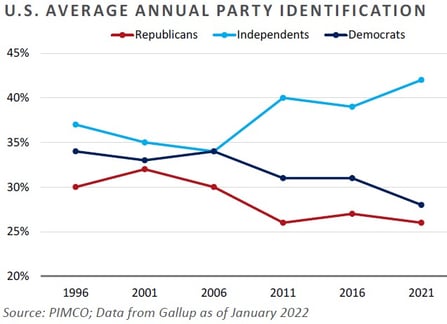

Based on an audience question, Ms. Cantrill addressed who might stand out (and potentially succeed) in the 2024 election. Ms. Cantrill cautioned that presidential race predictions around the midterms are reliably wrong, given the world of possibilities between midterms and the election. Remarkably, a record number of Americans are identifying as “independent,” which begs the question posed to Ms. Cantrill by an audience member: “Are these really the best candidates we have?” to which she replied, “Only time will tell.”

One thing was clear during the Q&A portion of this session: all investors in the U.S. are looking for strong and sound guidance from the leaders of this country. To that end, FEG plans to continue tapping invaluable resources such as Ms. Cantrill to provide our clients with clear perspectives on the cloudiness of public policy.

The Great Energy Debate

Christian Busken, SVP and director of real assets at FEG, hosted two panelists, John Baschab, co-founder and managing partner of Scout Energy Partners, and Rod Saddington, CEO & CIO of Mereweather Investment Management, LP, to discuss the state of the world’s energy markets through the eyes of public and private market participants. Year-to-date, the S&P energy sector has outperformed the broader S&P 500 index, returning 31.3% relative to the 13.9% drawdown in the S&P 500 through April. The result is energy coming front and center for investors, consumers, and public policymakers alike given the recent market turbulence, rising energy costs, and geopolitical events of late. Mr. Baschab offered his perspective from the private sector, explaining that he “didn’t realize how out of favor private energy was over the past five years until [he] was recently invited to speak on panels again,” while Mr. Saddington provided insight on the long-time mismanaged and underperforming public sector. Mr. Saddington provided an historical context to energy investing where portfolio managers have viewed the sector as just ‘beta long’ and simply attempted to ‘time the cycle’. This historically has resulted in getting the energy cycle wrong and having ‘peak drawdowns off peak capital’. However, if you have a hedged strategy which understands the ‘value chain’ by each fuel source (oil, natural gas, LNG, NGL, Solar, Wind, Renewable Diesel etc.) you can construct a portfolio of longs and shorts that have changing fundamental economics and hence generate returns ‘through the cycle’. At different points in the cycle the margin accrues to different parts of the energy value chain. Energy markets are complex and energy is a ‘depleting asset business’ meaning that the equity values and reinvestment profiles are constantly changing, therefore the equities are consistently mispriced (over and underpriced). The backdrop for public market energy investing is positive since energy is still underweight at most asset management firms and that energy weighting in major indexes is about to increase significantly with the increasing earnings power. Energy is around 4.8% S&P 500 yet will account for an estimated 8% (or greater) of S&P earnings this year. Given a higher mid-cycle price (not just looking at spot prices) of all energy commodities this earnings progression is structural.

How would you characterize the state of the energy markets today?

When asked about the state of energy markets today, Mr. Baschab explained that cheap money and ever-evolving technologies have paved the way for an onslaught of supply and commodities over the past decade. Since the pandemic, however, private energy markets have struggled with underinvestment from LPs and an inability to attract new capital, as well as volatile price swings and policy uncertainty around traditional energy markets. Mr. Saddington talked about the mismanagement of public E&P companies which has led investors to demand that companies clean up their balance sheets, operate within cash flows, and return capital to investors through increased dividends and share buybacks. Mr. Saddington identified it is a ‘supply side’ cycle, with capital discipline in the USA but also significant underspending since 2014 across all OPEC and NON OPEC. He used the analogy of the US Airline Supply side rationalization, where M&A, capacity rationalization, significant underspend changed the market structure of the US Airline sector allowing outsized profitability for a decade prior to Covid 19. US Airlines were also once seen as ‘not investable’.

Why haven't domestic companies rushed to increase production in the face of high prices?

The next question was on the relative lack of production given the high prices in energy. Mr. Baschab explained that producer discipline is current in vogue. After the scare in 2020 with negative oil prices, lenders began forcing operators to increase hedging on production at $30-$60/barrel, and those producers who survived the scare have begun paying down their debt and cleaning up their balance sheets to shore up their capacity to weather another correction which, according to the futures curve, is not that far away. Mr. Saddington pointed out that public investors in E&P companies have experienced poor treatment since as far back as 2014, when producers often stretched beyond ideal financial and operating leverage in hopes of capitalizing on rising prices. However, today’s investors are scrutinizing capital discipline and punishing E&P companies that even consider increasing production in this environment.

For those who don't follow the natural gas market, what is driving this price change and how does it affect markets and investors?

With natural gas up 104% year-to-date, both Mr. Baschab and Mr. Saddington had insights on what might be driving this change and how it is affecting markets and investors. Mr. Baschab attributed the increase to the dwindling reserves of associated gas-rich basins. He also noted that private operators are on the hunt for new basins with robust takeaway capacity. Mr. Saddington observed that energy security has become a global issue, with natural gas gaining wide acceptance as a reliable source of energy compared to coal. Moreover, the Russian invasion of Ukraine and subsequent sanctions on Russian natural gas highlighted the need for a secure source of natural gas to the region, which the U.S. has stepped in to provide. This represents a structural change in Global Gas & LNG markets as Russia is removed as a ‘baseload’ provider of natural gas to Europe. Given this, gas prices will naturally be expected to rise as natural gas becomes a global commodity.

How does the evolution of the energy transition affect markets?

In terms of the evolution of the energy transition, Mr. Baschab stated that a record amount of capital has ben raised to fund projects and ideas considering institutional divestment mandates. Operators in the renewable and energy transition stage are enjoying an incredible amount of goodwill from the public, including policy support and subsidies, but projects still require significant investments to get up and running. Mr. Saddington observed that the recent regulatory backdrop has not been supportive with the failure of the Build Back Better bill and NEM 3.0 which was negative for California Solar. In addition TMT funds which on average have suffered significant negative returns in 2022 have exited the new energy space creating further volatility in these stocks. This environment does create opportunity to build positions in the industry leaders where the business model will create ‘free market’ value versus being solely reliant on ‘regulatory’ revenues. The energy transition is required, however, the opportunity set will vary significantly. For example, renewable natural gas economics relating to ‘landfills’ are very positive versus say competing in the mobility or EV charging space where you will have to compete with the oil majors marketing businesses which is a ‘fully depreciated’ asset base.

The session ended with a brief Q&A in which Mr. Saddington and Mr. Baschab agreed that although there are some incredibly rich basins in the northeastern U.S., the regulatory hurdles and public disapproval of these projects makes it highly unlikely that production and takeaway capacity will increase anytime soon. They also talked about public versus private opportunities and explained that private energy investment allows the investor to fully align with an operator and fellow investors without any style drift, while public markets offer liquidity and broad opportunities. If the goal is risk management, they believe investors should seek exposure to both public and private managers. Ultimately, the session made one thing clear: energy will continue to be front and center for consumers, investors, and policymakers, which is why FEG is committed to continuing to provide timely insights on the latest developments in energy markets and key opportunities for clients.

|

"The decline of the production curve has hidden behind incredible technologies and cheap financing for the past decade. The decline curve never sleeps." − John Baschab |

The Biotech Panel: Learning to Fly

Nolan Bean, head of institutional investments at FEG, introduced the two panelists, Eli Casdin, chief investment officer and founder of Casdin Capital, and Kush Parmar, managing partner at 5AM Venture. Biotech has seen rapid evolution since the seed stages of the industry in the early 80s and has grown to become a pivotal part of the development of lifesaving therapies, drugs, and treatments. While investing in biotech had, up until recently, been a prolific allocation, recent underperformance in the public markets has shone a new light on the volatile nature of the industry. Mr. Casdin and Mr. Parmar offered timely insights on why investors should continue to have conviction in the path forward for biotech, why the public market has seen consistent downward pressure, and how the industry is still young and “learning to fly.”

Negative Screening/Divestment

Negative screening is the most commonly used approach by investors focused on being socially responsible. This approach calls for the exclusion of companies or industries an investor might consider morally unsuitable given their unique mission and values. Negative screens are also often used as a means to enact political and social change. For example, divestment played a role in investors choosing to seek social changes such as fighting apartheid in South Africa, going “tobacco free,” promoting “no sin stock” investing, and, more recently—particularly of topic for some universities, driven by student activism—“fossil fuel free” investing.

What is biotech?

Biotech—short for biotechnology—is the implementation of the study of living organisms with the intention of improving the health of people and the planet. Mr. Parmar explained that the biotech industry sits within the broader “life sciences” category and employs the scientific study of life with the significant technological breakthroughs the world has achieved over the past decades.

How has the industry evolved?

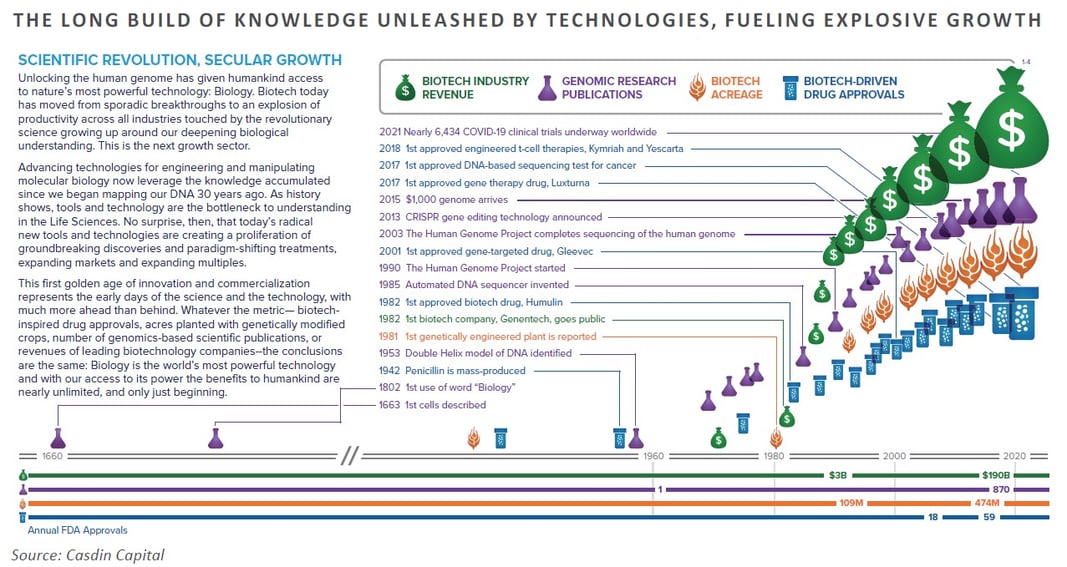

Mr. Casdin explained that while the industry is still relatively new, the entrepreneurialism and industrialization of the ecosystem have pushed progress forward substantially. Small biotech companies which “in the mid-80s had a failure rate close to 100% and a royalty payment close to 2%” now, close to four decades later, are at a point where they have a success rate closer to 30-50% and a seat at the negotiating table with the large pharmaceutical companies. Mr. Casdin noted that the human genome project took 13 years and $300 billion to bring the technologies to market. CRISPR gene sequencing can now be done for a cost of thousands rather than millions, and on a much shorter timeline. Large pharmaceuticals have historically been the one-stop-shop for drug research, development, marketing, and distribution. But as biotech companies have grown, large pharma has become more of the “marketing and distribution” desk for drugs and treatments developed by biotech companies that have finally “secured their spot at the negotiating table” and, for some, have gone from no profits to “record profits.”

What's happening in the markets?

While the market has been considerably rough for the first part of this year, Mr. Casdin referenced the past cyclicality of the biotech sector, which, in his words, has “taken its fair share of punches and managed—and in some instances, thrived.” In the context of a bull market, biotech is “nowhere near the episode of the pre-2000 markets, as the recent drawdown we see today is orders of magnitude smaller on a peak-to-trough metric.” Relative to previous bear markets, Mr. Casdin pointed out that the success rates of drugs are orders of magnitudes higher, products are reaching the markets faster, and the industry is in “a better place than it has ever been.” Biotech markets are volatile; while recent valuations are shocking, in some respects they aren’t surprising. Mr. Casdin noted that some companies are trading less than their enterprise value on the premise that they are burning cash at a rapid rate. While it is true that these companies are spending hundreds of millions of dollars every year, on the back of a rising interest rate environment, Mr. Casdin noted that these companies are not in the same place they were last cycle and that they have “more sophisticated capabilities to bring products to market relative to the past.”

The path forward: what's next for the market and the industry?

Biotech has gone from clinical trials searching for correlations that were unsuccessful shots in the dark to using recently developed technologies to peer into the molecular and genetic causes of diseases. The toolkit has evolved. Mr. Parmar explained that the industry has seen the capital market spigot opened, and that capital has been undisciplined in some cases. He observed that the recent downturn in public markets will no doubt have run-off effects on the private market, but the quality and rigor of companies that emerge now, considering the environment, “will prove to be robust.” Moreover, he stated that as barriers to entry and the cost of technological requirements come down, there will be continued innovation. Additionally, Mr. Parmar believes “all of the macro fundamentals are unchanged. There are aging populations, technological integration, and continued genetic breakthroughs” that will buoy the industry. He pointed out that there are currently companies which have blown out of the market and become dislocated from their fair value, representing an opportunity where “winners are out there for the picking.” For his final insight, Mr. Casdin reflected, “You make the most money in a bear market, you just don’t realize it at the time.”

|

about pegasus park Tom Luce, CEO of Biotech initiatives; Lyda Hill, CEO of Lyda Hill Philanthropies

Tom Luce, CEO of Biotech Initiatives, and Lyda Hill, CEO of Philanthropies, joined us for a brief presentation on Pegasus Park, a unique center for business, social impact, and biomedical innovation. Designed as a catalyst to grow the biotech healthcare sector in Texas, Pegasus Park is home a wide range of occupants, from entrepreneurial startups, to nonprofit and philanthropic organizations, to industry leaders, and even collegiate partners (UT SouthWestern occupies five floors of the main building). In addition to its impressive bio labs and other state-of-the-art scientific equipment, the complex is zoned for an additional one million sq. ft., which means it has ample room to grow and transform to meet the needs of its tenants and the regional biotech industry.” |

Bio-Innovations Through a New Lens

Ben Lamm, founder and CEO of Colossal, sat down with guest host Claire Aldridge PH.D, SVP and chief of staff and corporate strategy at Taysha Gene Therapies, to have a timely conversation about Mr. Lamm’s venture to bring back the wooly mammoth, the ethics of responsible business development, the rapid development of synthetic biology, and the secret to making early-stage businesses successful.

What makes you a successful entrepreneur? How do you build businesses?

The difficulty of starting and running a successful business is not lost on Mr. Lamm, who believes that the key to building a successful company is surrounding yourself with people who are smarter than you, and then actually following through with that concept through effective hiring. While many entrepreneurs will say that they do this, Mr. Lamm believes that some fall short, and this can detriment the core of a company. While he often gets the spotlight of his companies, Mr. Lamm sees his role as a supporter. His goal is to ensure that his people are getting what they need, when they need it, whether that be money, facilities, or connections. “When you give people what they need without micromanaging them, they’ll do crazy things. They’ll bring back wooly mammoths!”

On the topic of mammoths, what is the goal of colossal?

Colossal is a co-project between Mr. Lamm and George Church, a world-renowned geneticist and faculty member of Harvard University. Their venture Colossal is focused on the de-extinction of the wooly mammoth through the implementation and development of synthetic biology. With the invention of CRISPR, a gene editing tool first invented in 2013, Mr. Lamm believes that the human race is at an inflection point where we can decide to act on the pressures of climate issues and restore lost flora and fauna.

While the initial goal of Colossal is to bring back mammoths to the tundra in an effort to curb arctic methane releases and counteract climate change, the dream is much larger. The Earth is expected to lose 50% of its biodiversity by 2050 due to man-made climate change and habitat destruction. Through synthetic biology and Colossal’s efforts to leverage gene editing technologies to create and/or modify organisms, the hope is to apply this approach to critically endangered or extinct animals or plants and, one day, maybe even to humans. But these large leaps don’t come without significant advances in human knowledge and scientific discovery.

Click here to watch a video on Mammoth De-Extinction.

How do we encourage scientific discovery?

Listen…a lot. There are a ton of smart, curious individuals with amazing ideas that ultimately don’t come to life. There is an importance to being curious and hearing out creators and their ideas. There are creators that have ideas to solve the loss of species, solve hunger, or solve gene therapies and cure diseases. But, while we see and hear these things, Mr. Lamm points out that they often don’t end up going anywhere, “they stay nebulous.” This is where the importance of listening comes in to play—Mr. Lamm has focused on finding topics, listening, and diving deep into them. This eventually may lead to great technologies, as was the case for CRISPR and now synthetic biology.Conclusion

While each session covered a very distinct topic, our speakers raised some common themes throughout their messages, such as the need for ongoing innovation, the importance of paying close attention to market moves and participants to discover opportunities, and the impossibility of predicting future outcomes with any real accuracy. Each presenter acknowledged that the market situation at present may not be ideal for any number of reasons, but all were optimistic about what the future holds. We believe that to achieve long-term objectives, investors should pay attention, remain nimble, and focus on the future.

FEG would like to express our sincere gratitude to those clients and friends of the firm who attended the symposium, to our speakers, and to Pegasus Park for making the day possible. If you are interested in joining us at our next event, we’ll be holding our 10th Annual Forum in fall 2023 in Cincinnati, Ohio, and we’d love to see you there.

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Published June 2022