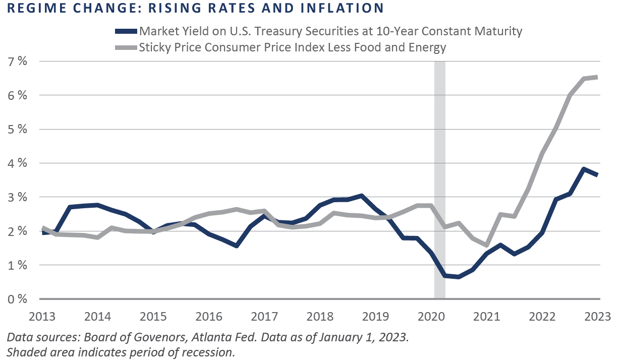

Coming off a decade of ultra-low interest rates and high growth, the market environment for the past year—triggered by the shift in Federal Reserve (Fed) policy to fight inflation—has been volatile. Risk assets, including private equity, have benefited from the Fed-supported economy. This recent volatility has left investors wondering what the so-called “regime change” might mean for longer duration, locked-up investments and whether the old rules still apply, or if they need to start adapting to a whole new ballgame.

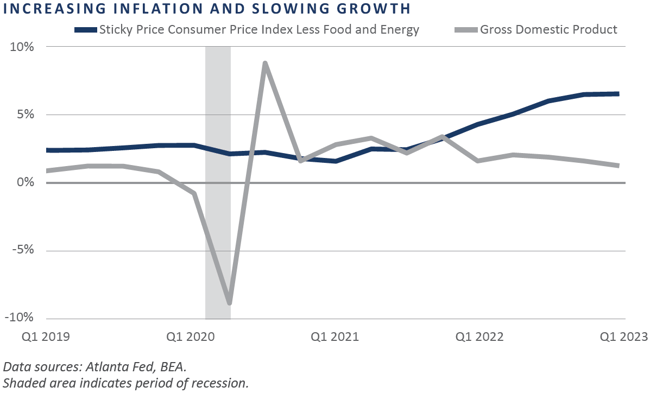

The impact of higher interest rates is multifaceted. Higher rates increase the cost of borrowing and typically slow growth. Regime change also introduces uncertainty. Ultimately, these factors pressure valuation multiples, the price buyers are willing to pay for a company.

The private markets are no more immune to economic headwinds than public companies, but FEG believes long-term investors will continue to benefit from exposure to private investment opportunities and that the private markets will continue to grow.

Venture Capital – Momentum Killer

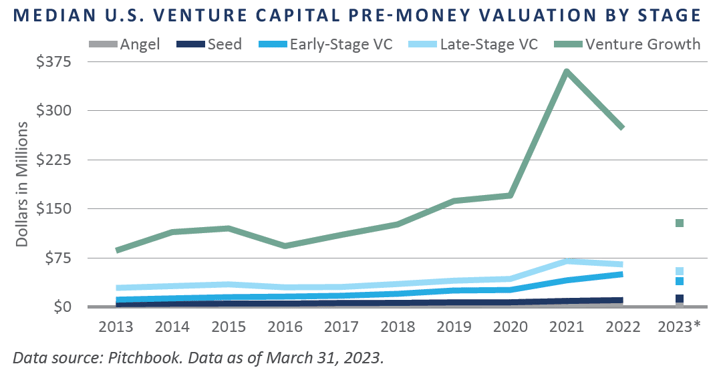

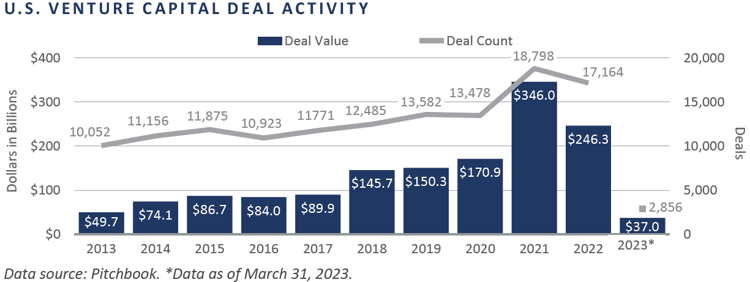

Rapidly rising inflation and interest rates has had an immediate impact on the venture capital sector. Venture investing is a bet on high growth with no near-term yield. With higher interest rates, the theoretical cost of carry for these assets with an implied long duration has increased, reducing their value.

The valuation impact was particularly evident in the past year in later-stage venture investments. In the post-COVID period, aggressive bets on what were anticipated to be pre-Initial Public Offering (IPO) round financings by new market entrants accelerated, but the rise in rates has caused investors to hit the reset button on valuations.

Buyouts – No More Fat Pitches

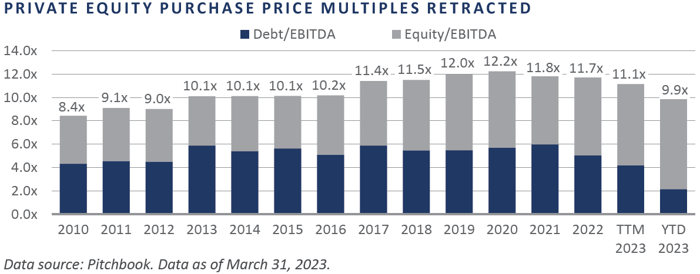

Higher interest rates have also impacted the buyout sector—most significantly for strategies employing greater amounts of debt in their capital structures, or that have been most aggressive in their use of lines of credit. Just like in the housing market, cheap credit allows buyers to pay more.

The impact in late 2022 and early 2023 has been sharp. The higher cost of debt slowed deal activity. For those deals that moved forward, most were done with more equity and less debt.

Even for companies with limited leverage, the price buyers are willing to pay for a company has declined. Pressure on valuation multiples can thus filter down from larger to smaller companies.

Slowing Growth

Historically, the higher the interest rates, the slower the economy. Nominal GDP growth averaged 3.8% for the past decade of ultra-low rates.1 At present, expectations of slowing growth and a possible recession loom.

Based on the simple math of buying a company, lower GDP growth dampens the forecast for future earnings. Lower expected future earnings translates to a lower price a buyer is willing to pay today.

Uncertainty in Spades

It is well known that markets do not like uncertainty, and investors are currently facing uncertainty in spades. In addition to higher interest rates and potentially slowing growth, the psychology of making a major investment requires confidence in the future. When times are uncertain, the margin for error naturally increases, again pressuring prices. Trends in deglobalization, the Russia–Ukraine war, the stability of the banking sector, political dysfunction in the U.S., and climate change are some of the factors compounding negative sentiment. The consequence of these highly unpredictable factors is slowing transaction volume.

While the Pace May Slow, the Game Remains the Same

Operating successfully amidst a backdrop of higher rates is not new. Private markets have grown dramatically over the past 20 years, but not just because of low or falling interest rates. Since the 2008 Global Financial Crisis, new pressures of operating as a public company and new restrictions on bank activities made private investing an attractive alternative and investors adapted.

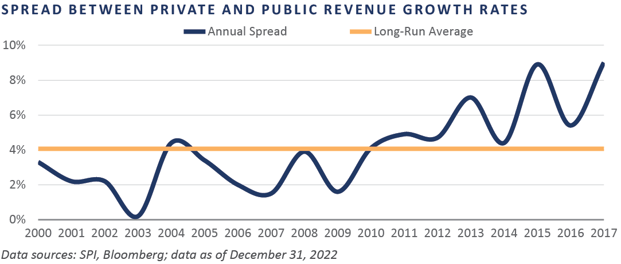

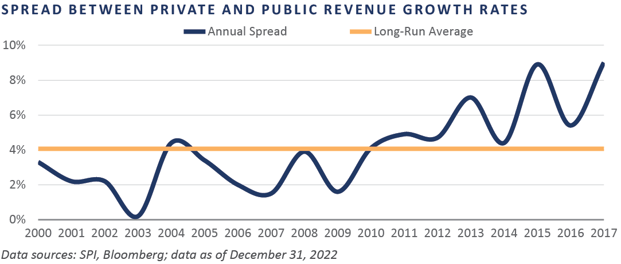

The structure of private investing may be a superior form of ownership for certain types of investments. Those that play the game well tend to have a clear strategy, strong governance, and aligned incentives. Of course, not all private funds do this well, and none are batting 1000, hence the wide dispersion in returns. In aggregate, however, per the SPI chart, private companies have historically created stronger revenue growth—a 4% premium on average—compared to similar public companies. Higher interest rates do not change the model that produced these results, even if reduced liquidity or more restrictive lines of credit slow the pace. So yes, we are still playing baseball.

What Inning is It?

While the tailwinds for private investments may have stopped, they have done so for all risk assets, public and private, so a change in the mix of public versus private equity in a portfolio in response to the changing market environment is not warranted. In addition, timing private investments is difficult if not impossible. In a paper written in 2020, Steven Kaplan, professor at the University of Chicago Booth School of Business, observed that it might make sense to cut back slightly on new commitments when pricing is high and to increase commitments when pricing is below average, but consistent investing through cycles has historically yielded similar results.2

Are Valuations Correct?

As noted above, multiple factors point to declining valuations. The broad impact on venture capital and buyout markets is evident, but have the declines to date been enough?

Preliminary Burgiss data indicated the average U.S. venture capital fund declined 8% in the fourth quarter of 2022 and 22% over the full year.3 While several high-profile late-stage venture / growth investors marked portfolios down 30% in the fourth quarter, earlier-stage declines were not as dramatic.4

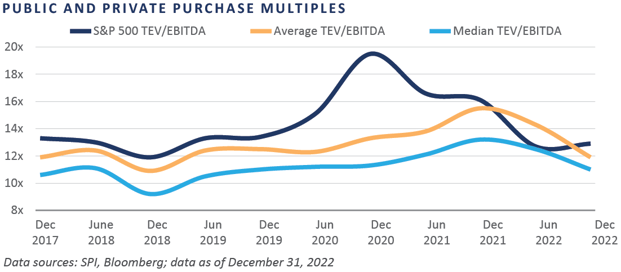

Per the same report, the average U.S. buyout fund was modestly positive in the fourth quarter of 2022 and flat for the full year. Investors are skeptical that underlying private company valuations fully reflect the decline in purchase price multiples.

Keep in mind that market multiples are one factor in valuing companies. Earnings growth and debt reduction are also important factors in the valuation equation and can – and in the fourth quarter have offset the impact of declining multiples.

Public market investors note that private valuations have not fallen as far as public stocks. This is true but not necessarily wrong. Using the S&P 500 as a benchmark, purchase multiples for private companies lagged that of public peers over the post-COVID period and saw stronger performance in 2022 as well.5 By the end of 2022, purchase price multiples for public companies rebounded and the relationship with private multiples normalized.

Next Up

While the macro backdrop is important, trends that play out over decades are typically more significant drivers of long-term returns. Some of those current trends are negative—deglobalization, for example—but many are positive.

In venture capital and growth equity, software adoption across the economy has continued and is likely to accelerate. Several powerful artificial intelligence models have been rolled out over the past year, and many believe these programs will be industry disruptors. In a recent episode of the a16z podcast (episode 716), Nvidia’s CEO, Jensen Huang, stated, “We are in the iPhone moment of AI.” 6

ChatGPT launched in November 2022 and content creation by artificial intelligence (AI) has already exploded. The program’s ability to analyze unstructured data is profound and it is estimated that over 85% of all digital content is unstructured. A long-time investor once told this writer it is the application of new technology, not just its creation, that drives value. The applicability of generative AI feels endless at the moment. While regulation is likely—and the European Union is ahead of the U.S. on this front—hopefully a strong regulatory framework will help ensure the technology is used in ways that support humanity rather than exploit it.

Biotech and innovation in healthcare is another area of tremendous change and opportunity and volatility. Just last week, this writer sat in a board room with three cancer survivors. All had benefited from advanced treatments that came from genomic research—the sequencing of which was completed in 2003—and likely would not be alive today without it.

Buyout investments broach a full swath of economic sectors and end markets, making broad-based commentary difficult. Certainly, tech-focused buyouts struggled in recent months while more recession-resistant strategies were stable. This diversity is a strength, however, because the economy benefits from innovative owners of businesses willing to take risks and adapt to consumer demands. Although there has been some backlash for focusing on environmental, social, and governance (ESG) factors, it is interesting to witness impressive examples of strong governance, advances in reducing the environmental impact of industrial processes, and a push for funding and promoting diversity. These initiatives are aligned with pure profit motivation—the practices of strong management teams seeking to grow strong, sustainable businesses.

Final Thoughts

Significant uncertainty remains for the economic outlook and near-term market performance. Further declines in valuation of some private investments are certainly on the horizon as innovation and disruption continue. Private markets are not immune to these forces, but they are able to operate without focusing solely on near-term earnings.

We believe, Investing in a diverse portfolio of both public and private markets is likely to best serve investors with a long-term investment horizon that can accept some level of illiquidity. There is a growing understanding of how market forces impact a private portfolio and the sometimes confusing impact of a delayed valuation process. At present, the private markets encompass approximately $10 trillion of investor capital, while global public markets capture over $100 trillion.7, 8 FEG anticipates there is room and reason for private markets to continue to grow and for dispersion of outcomes to remain significant, but emphasizes that a selective approach to sourcing and identifying investment opportunities continues to be important.

1 Federal Reserve of St. Louis Economic Research, FRED, https://fred.stlouisfed.org/

2 Brown, Gregory W. and Harris, Robert S. and Hu, Wendy and Jenkinson, Tim and Kaplan, Steven Neil and Robinson,

David T., Can Investors Time Their Exposure to Private Equity? (January 22, 2020). Kenan Institute of Private Enterprise

Research Paper No. 18-26, Available at SSRN: https://ssrn.com/abstract=3241102 or http://dx.doi.org/10.2139/ssrn.3241102

3 Burgiss Global Private Capital Performance Report, 2022 Q4.

4 WSJ, Tiger Global Writes Down Venture Funds Bests by 33% in 2022, www.wsj.com, March 16, 2023

5 Stepstone Group LP, Stepstone Inside Private Markets, Are Private Equity Valuations Too High?,

www.stepstonegroup.com

6 a16z Podcast, From Promise to Reality: Inside a16z’s Data and AI Forum, Episode 716, May 2, 2023.

7 Burgiss Global Private Capital Performance Report, 2022 Q4.

8 www.sifma.org/research

DISCLOSURES

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.