The Cascading Impact of the Fed’s Rate Cuts on Private Credit

With 2025 on the horizon, the U.S. private debt market is at a crossroads. In September, the Federal Reserve (Fed) cut its target rate by 50 basis points and cut another 25 basis points in November. While the cut was widely expected, the size of the cut was surprising. Furthermore, as the Fed pivots to focus on the unemployment portion of its dual mandate, further reductions in base rates are anticipated in the next 12 months.

If the topic is private lending, why bother discussing the Fed’s balance sheet and its recent shift in monetary policy? Base rates are foundational to public and private lenders, and the Fed’s policy actions indirectly impact base lending rates. As the Fed seeks its soft-landing scenario, reduced base rates should help ease conditions in the leveraged buyout market, increase mergers and acquisition activity, and improve the exit environment for private capital managers.

THE FED MAKES ITS MOVE

Investors initially welcomed the Fed’s policy move, but quantitative tightening (QT)—where the Fed gradually winds down its balance sheet via the outright selling of Treasuries or mortgages or allowing bonds to mature—continues and is expected to taper off sometime in 2025. The Fed’s policy shift is a moderate easing, as QT remains restrictive. After the Great Financial Crisis in 2007-2008 and following the COVID-19 pandemic in 2019-2020, the Fed’s balance sheet grew significantly, peaking at ~$9 trillion in April 2022. It now stands at just over $7 trillion.2 Ending QT could boost short-term growth and benefit lenders and borrowers, but it also might increase long-term inflation.

IMPROVING CONDITIONS FOR BORROWERS

Lower base rates are a boon for borrowers and positively impact interest coverage ratios. For the uninitiated, the interest coverage ratio measures a company’s ability to pay interest on its outstanding debt. It is calculated by dividing the company’s earnings before interest and taxes (EBIT) by its interest expense during a given period. This ratio indicates how well a company can cover its interest obligations with earnings. A higher ratio suggests that the company is more capable of meeting its interest payments, while a lower ratio may indicate potential financial difficulties. The private credit interest coverage ratio chart attests that higher base rates in recent years led to lower interest coverage ratios. The opposite should also hold, with lower base rates leading to higher interest coverage ratios in the future.

THE IMPACT ON PRIVATE MARKETS

When private credit and direct lending—essentially commercial banking functions—are considered “hot” on Wall Street, reasonable contrarians might see it as a signal to exit. Higher base rates from the Fed’s tightening cycle in 2022 and 2023 created attractive return opportunities and new long-term investors for these strategies. The cash flow-oriented private lending markets are generally defined by floating-rate, senior, and unitranche debt and fixed-rate, mezzanine debt, which comprise the entire debt portion of the typical private company balance sheet.

Private loans generally perform from the origination date and are typically designed to stay that way to maturity. Cash flow-oriented challenges can arise throughout the loan, making covenants and credit underwriting important. When challenges arise, corporate borrowers can look to the lender to make amendments or consider capital solutions options for their balance sheets from other credit managers, often at a higher cost of capital.

In this table, recent pricing ranges for the private lending markets versus one year ago show tighter pricing, lower yields, and slightly higher leverage put on companies at origination. The “S” in pricing represents the three-month Secured Overnight Funding Rate (SOFR). SOFR replaced the London Interbank Offered Rate (LIBOR) as a key reference rate that reflects the cost of borrowing cash secured by U.S. Treasury securities in 2021. The three-month SOFR declined to ~4.8% from 5.3% when the Fed cut interest rates in September and moved to ~4.6 after the November cut. Despite these changes in market conditions, returns for private loans represent total yields of ~10-12% for senior and unitranche debt, with higher yields possible in the more stable fixed-rate mezzanine debt space.

STUCK IN THE MIDDLE

With a turn of leverage from a commercial bank, private senior and unitranche loan returns can surpass those of mezzanine debt. In response, mezzanine debt lenders typically include equity co-investments alongside their loans to boost gross returns into the upper teens, which keeps their return profile strategically competitive. The boost in performance from equity co-investments is critical as mezzanine debt funds are typically more concentrated than senior and unitranche funds. To the extent one or more loans in a fund deteriorate in value, the cumulative benefit of equity co-investments can help support its return. Nevertheless, new mezzanine debt funds have struggled to raise assets in an environment where direct lending funds have saturated the market. With the Fed’s shift in monetary policy now underway, investors may shift their appetite toward mezzanine debt as spreads between senior and mezzanine debt widen.

PLAYING NICE WITH CAPITAL SOLUTIONS

FEG allocates assets to private debt managers across the entire private debt landscape. Strategies range from the previously discussed performance-oriented private lending strategies to counter-cyclical strategies such as distressed debt. The breadth of FEG’s platform offers a unique perspective that provides color throughout the credit cycle. In fact, some of the strategies have begun to overlap due, in part, to a lack of a broad distressed opportunity set. For example, some distressed debt-oriented managers view the multi-year growth of direct lending as a potential opportunity set and have started allocating capital to these opportunities, calling them “capital solutions.”

Distressed debt managers using a capital solutions approach provide short-term capital to help companies during financial stress or help restructure their balance sheets. Unlike the distressed-for-control strategy, which involves buying debt at a discount and taking control of the company, the capital solutions approach aims for quick repayment and reinvestment. Although the distressed-for-control strategy can yield higher returns, it takes longer than the capital solutions approach.

Many distressed debt managers have shifted from the distressed-for-control strategy to the capital solutions strategy due to low default rates in private debt, partly because of the “friendly lender” approach. Proskauer reported a 1.8% default rate in the first quarter of 2024, down from 2.2% in the first quarter of 2023.3 Despite strong financial covenants, private lenders are often unprepared for full restructurings, especially if multiple companies are affected simultaneously during a downturn.

Private lenders commonly co-invest in a modest equity position and provide debt, creating a partnership lending approach rather than an adversarial one. This approach aims to achieve targeted returns through interest payments and equity rather than restructuring companies. For example, some lenders allow companies to suspend interest payments temporarily to avoid defaults, hoping for full repayment once the borrower recovers financially. This strategy helps maintain the lender’s reputation and ability to grow its platform.

CONCLUSION

The Fed’s unexpected 50 basis-point rate cut in September and additional cut in November has lowered base rates for floating-rate loans, reducing interest burdens and default risk for companies while improving their interest coverage ratios. However, this also means lower returns for investors. Private debt has maintained low default rates due to a “friendly lender” approach, where lenders co-invest equity and provide debt to support companies rather than force defaults. This strategy helps lenders achieve targeted returns and maintain a positive market reputation, resulting in lower default rates than expected. Other strategies, such as asset-based lending, real estate debt, and specialty finance, are gaining investor interest and offer comparable returns to cash-flow lenders. FEG continues to minimize credit risk by emphasizing manager selection and vintage year diversification.

1 Secured Overnight Financing Rate (SOFR) – a benchmark interest rate for dollar-denominated derivatives and loans, which replaced the London Interbank Offered Rate (LIBOR). SOFR is based on transactions in the Treasury repurchase market, which suggests it is a reliable and transparent rate that is difficult to manipulate.

2 https://www.federalreserve.gov/monetarypolicy/bst_fedsbalancesheet.htm

3 Proskauer Private Credit Default Index – tracks senior-secured and unitranche loans in the U.S. and includes 980 active loans representing approximately $150 billion in original principal amount.

PRIVATE EQUITY

Venture Capital

- The current venture capital (VC) landscape is significantly impacted by the scarcity of exits and near historically low distribution levels. Through September 2024, the U.S. VC asset class secured approximately $65 billion in aggregate commitments across 380 funds.1 While total annualized fundraising is on track to match 2023 levels, it sits at only half of the peak amounts achieved in 2022.2

- Venture deal counts have stabilized, but a significant market recovery is still pending. As of September 30, 2024, U.S. VC deal value volumes were down 9%.3 The slow recovery in VC deal activity is likely due to ongoing challenges hindering exits, fundraising, and dealmaking. However, deal value increased roughly 6% over the same period.4

- The median U.S. pre-money valuations for venture-backed businesses have risen. Compared to 2023, median pre-seed, seed, and early-stage valuations have increased 5%, 13%, and 36%, respectively.5 Median late-stage pre-money valuations have also climbed approximately 36%.6

- The exit environment remained challenging during the third quarter. U.S. VC exits totaled roughly $69 billion through September across 938 transactions.7 Distributions as a percentage of net asset value fell below 6%, a level not seen since the Global Financial Crisis.8

- U.S. VC performance contracted in the first quarter of 2024, with the spread between the top and bottom quartiles surpassing 1,000 basis points.9

INVESTOR IMPLICATIONS

Diminished exit activity and a lack of distributions negatively influenced investor demand for venture capital, and the impacts of the prolonged downturn in the asset class have yet to be fully realized. FEG advises clients to exercise caution when making new commitments.

1–8 Pitchbook; September 30, 2024

9 LSEG; March 31, 2024 (most recent available)

Leveraged Buyouts

- Private equity (PE) fundraising remains robust. Through September 30, 2024, the U.S. PE asset class has raised roughly $236 billion across 220 funds this year.1 The median time to close has grown to nearly 17 months, compared to 14 months in 2023 and 11 months in 2022.2

- U.S. PE deal activity continues to show strong signs of resurgence. As of September 30, 2024, deal value was up 23% from the prior year, driven by a 13% increase in deal volume.3 Add-on transactions represented roughly 75% of U.S. PE deal activity.4

- Private equity valuations appear to have peaked in 2021, given the declines of 2022 and 2023. However, enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples have recently increased. As of September 30, 2024, the median TTM private equity buyout purchase price multiple was 12.7x EBITDA.5 The median debt-to-EBITDA ratio was roughly 5.1x EBITDA.6

- U.S. PE exit activity continues to be depressed relative to recent levels. However, green shoots appear to be forming with an increase in overall value and volume witnessed in the third quarter. Year-to-date, U.S. PE generated 1,034 exits for an aggregate value of $303 billion.7 The median holding period of U.S. PE investments exit were roughly six years.8

- PE performance was strong through the first quarter of 2024, with the spread between the top and bottom quartiles topping 1,000 basis points.9

INVESTOR IMPLICATIONS

Despite deal and exit activity showing signs of improvement, private equity continues to face near-term challenges due to high interest rates, earnings volatility, and geopolitical tensions. FEG, therefore, advises clients to exercise prudence when making new commitments.

1–8 Pitchbook; September 30, 2024

9 LSEG; March 31, 2024 (most recent available)

Private Debt

- While the first half of 2024 suggested a stellar year for credit risk, that was reversed in the third quarter with weakness in the public credit markets. As the interest rate environment came into play—particularly in September following the Fed’s 50 basis-point rate cut— investors began re-pricing rates higher, impacting credit spreads.

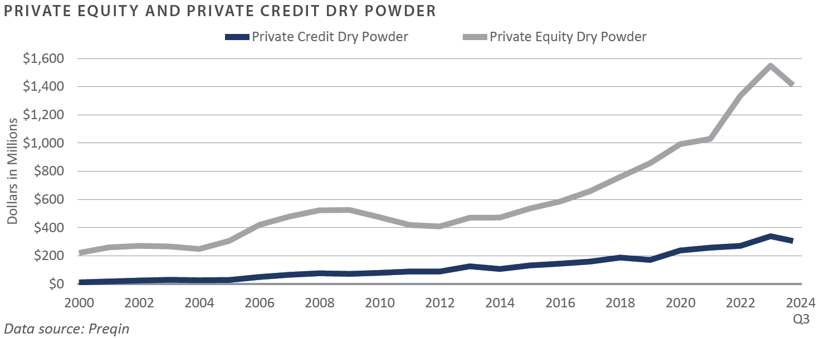

- Amid the shift in Fed policy to lower rates, private equity and private credit dry powder are likely to be deployed faster. Improved interest coverage ratios—which measure a company’s ability to pay interest on its outstanding debt—stemming from lower base rates may improve loan default rate expectations, increasing a shift from distressed-for-control opportunities to capital solutions.

- Despite expectations for lower base rates in 2025, private debt fundraising continued to improve, with $51 billion raised in the third quarter—76%, or $39 billion, of which was direct lending.1

INVESTOR IMPLICATIONS

The economy remains resilient, with the Fed cutting interest rates in a further attempt to orchestrate a soft landing. Lower base rates are expected, and the logjam of mergers and acquisition activity has the potential to improve in 2025, making private debt attractive versus lower-yielding public market equivalents.

1 Insights – Private Debt Q3 2024: Preqin Quarterly Update

Private Real Estate

- The National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index (NPI) increased 0.8% during the third quarter, its first positive quarterly return in two years. All property types posted positive returns except for the office sector. The office sector may be approaching a bottom, as the sector has seen slowing quarter-to-quarter decline rates. Market value-weighted cap rates based on appraisals for unsold properties in the index were essentially flat; however, for properties that sold, the average cap rate was significantly higher at 5.9%.1

- As measured by the FTSE NAREIT Index, public real estate securities rose 14%, benefiting from the Fed’s interest rate cut. All property sectors posted positive returns, led by office REITs, which rose 29.5%, and specialty REITs, which rose 26.7%. Fundamentals in some office markets—i.e., Southeast—appear to be stabilizing, and REITs with exposure to these regions have outperformed. With REITs viewed as a leading indicator for real estate pricing, the recent gains could point to a bottoming out in property prices.2

- Global private real estate transaction volume increased slightly relative to the same period in 2023 but was still down over 70% from the peak in late 2021. According to Preqin, the total deal value for the third quarter was $35.5 billion. North America saw 872 deals close, up from 747 in the third quarter of 2023.3

- According to Preqin, 114 private real-estate funds closed during the third quarter, raising $20 billion. This decreased from the second quarter, in which 195 funds raised $41 billion. Private real estate fundraising peaked in the fourth quarter of 2021 when 340 funds raised $97 billion. Fundraising timelines in private real estate are being extended, with over 40% of all funds in the market for approximately 18-30 months. As of the third quarter, over 2,700 private real estate funds were collectively seeking to raise $616 billion.4

- Private-label commercial mortgage-backed securities (CMBS) have been a bright spot in commercial real estate, with $29 billion in new issuance in the third quarter, bringing the year-to-date total to $72.7 billion. This represents a 175% increase over the prior year and sets expectations for total issuance to top $100 billion.5 Additionally, 13 real estate debt funds raised $1.3 billion during the third quarter, a significant decline from the $10.7 billion raised during the third quarter of 2023. Along with CMBS, debt funds continue to be a source of financing for real estate borrowers.6

INVESTOR IMPLICATIONS

Some signs point to a stabilization in the real estate market following two years of declines in property prices. Recent gains in REITs, particularly in the office sector, suggest this may be the case. The Fed’s September interest rate cut provided relief to property owners; however, yields on 10-year Treasuries have increased, leading to less certainty about financing costs. Also worth noting is the wall of real estate debt maturities over the coming two years, which will need to be resolved by borrowers and lenders. With further interest rate cuts now on the horizon, the market may see an increase in transaction volume, providing greater price discovery and clarity on valuations. Managers able to move across property types may be well-positioned as the rate of change in real estate markets continues to accelerate.

1, 2 NCREIF; September 30, 2024

3-5 Preqin; October 2024

6 Trepp CBMS Research; October 2024

Natural Resources

- Oil prices declined 16.4% during the third quarter, closing at $68.17/barrel, compared to $81.54/barrel at the end of the second quarter.1 Despite ongoing turmoil in the Middle East, with tensions between Iran and Israel escalating, oil declined throughout the quarter as concerns about weaker demand due to slower growth in China weighed on prices. Record U.S. shale production, which topped 13 million barrels per day, also led to lower prices. In early November, OPEC agreed to extend its output cuts through year-end, which pushed prices back above $70/barrel.2

- Natural gas prices rose 12.4% in the third quarter, closing at $2.92/MMbtu. Prices rebounded as rising temperatures in the U.S. led to increased demand through the summer months. Natural gas is quickly establishing its reputation as the dominant source of reliable electricity in the U.S. as demand from data centers soars. Natural gas now provides 43% of U.S. electricity, with wind, solar, and hydro a distant second, providing 21.4% of the country’s electricity.3

- Silver Hill Energy Partners IV and EnCap XII, both larger upstream private energy funds, reached their final closes in recent months, with EnCap XII raising $5.2 billion and Silver Hill IV raising $1.13 billion.4 Pearl Energy launched its fourth dedicated upstream fund, targeting $1.0 billion. The appetite for upstream energy among limited partners has recovered from the depths of the downturn, although fundraising remains challenging. Strong distribution activity from private energy funds has failed to stimulate demand. One newer trend in 2024 is the emergence of groups specifically targeting secondary interests and continuation vehicles in upstream funds, a niche area that could present a compelling area within private energy.

- In early August, Occidental Petroleum closed its acquisition of Crown Rock from Lime Rock Partners for $12.4 billion. The deal generated a 79x return on Lime Rock’s original $96.5 million 17-year investment, representing one of the highest-performing deals in the history of private energy.5

- Public energy companies remained focused on capital discipline, and their CapEx budgets were effectively unchanged, partly due to volatility in commodity prices. The total U.S. rig count increased slightly through the third quarter to 587.6 The natural gas rig count was 99, and the oil rig count rose to 487 at the end of the third quarter. The U.S. oil rig count peaked at 1,600 in the fall of 2014.7

INVESTOR IMPLICATIONS

One of the major themes to emerge in 2024 has been the recognition from the broader market of the significant demand for power driven by data centers, which comprise the physical infrastructure behind AI. Data centers require stable baseload power, and natural gas is likely to be the dominant energy source to meet the growing demand. More recently, technology companies have turned to nuclear energy as a source of stable power; however, nuclear comes with a myriad of regulatory complications that could make it difficult to access over the near term. Natural gas is, therefore, becoming more attractive due to its role in balancing the grid and the abundant U.S. supplies. Merger and acquisition activity in public upstream energy is leading to the sale of non-core assets, creating acquisition opportunities for private energy funds with available capital. There is a growing consensus that the energy transition will take longer than initially expected and that traditional energy will continue to be a vital part of the energy mix for the foreseeable future. This should result in robust investment opportunities in multiple areas of the evolving energy landscape.

1-3 Energy Information Administration www.eia.gov; September 30, 2024

4 EnCap Investments; October 2024 and Silver Hill Energy; August 2024

5 Lime Rock Partners; August 2024

6-7 Baker Hughes; September 30, 2024

INDICES

Bloomberg US Corporate High Yield Index represents the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. The index includes the corporate sectors: Industrials, Utilities, and Finance, encompassing both U.S. and non-U.S. Corporations. See www.bloomberg.com for more information.

The Russell Indices are constructed by Russell Investment. There are a wide range of indices created by Russell covering companies with different market capitalizations, fundamental characteristics, and style tilts. See www.russellinvestments.com for more information.

The FTSE NAREIT Composite Index (NAREIT) includes only those companies that meet minimum size, liquidity and free float criteria as set forth by FTSE and is meant as a broad representation of publicly traded REIT securities in the U.S. Relevant real estate activities are defined as the ownership, disposure, and development of income-producing real estate. See https://www.londonstockexchange.com/indices?tab=ftse-indices for more information.

The S&P 500 Index is capitalization-weighted index of 500 stocks. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NCREIF Property Index is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only.

HFRI ED: Distressed/Restructuring Index — Distressed/Restructuring strategies which employ an investment process focused on corporate fixed income instruments, primarily on corporate credit instruments of companies trading at significant discounts to their value at issuance or obliged (par value) at maturity as a result of either formal bankruptcy proceeding or financial market perception of near term proceedings. Managers are typically actively involved with the management of these companies, frequently involved on creditors' committees in negotiating the exchange of securities for alternative obligations, either swaps of debt, equity or hybrid securities. Managers employ fundamental credit processes focused on valuation and asset coverage of securities of distressed firms; in most cases portfolio exposures are concentrated in instruments which are publicly traded, in some cases actively and in others under reduced liquidity but in general for which a reasonable public market exists. In contrast to Special Situations, Distressed Strategies employ primarily debt (greater than 60%) but also may maintain related equity exposure.

Information on any indices mentioned can be obtained either through your advisor or by written request to information@feg.com.

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Bloomberg Data Disclosure: Source- Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

Investments in private funds are speculative, involve a high degree of risk, and are designed for sophisticated investors.

An investor could lose all or a substantial amount of his or her investment. Private capital funds’ fees and expenses may offset private capital funds’ profits. Private capital funds are not required to provide periodic pricing or valuation information to investors except as defined in the fund documents. Private capital funds may involve complex tax structures and delays in distributing important tax information. Private capital funds are not subject to the same regulatory requirements as mutual funds. Private capital funds are not liquid and require investors to commit to funding capital calls over a period of several years; any default on a capital call may result in substantial penalties and/or legal action. Private capital fund managers have total authority over the private capital funds. The use of a single advisor applying similar strategies could mean lack of diversification and, consequently, higher risk.

All data is as of September 30, 2024 unless otherwise noted.