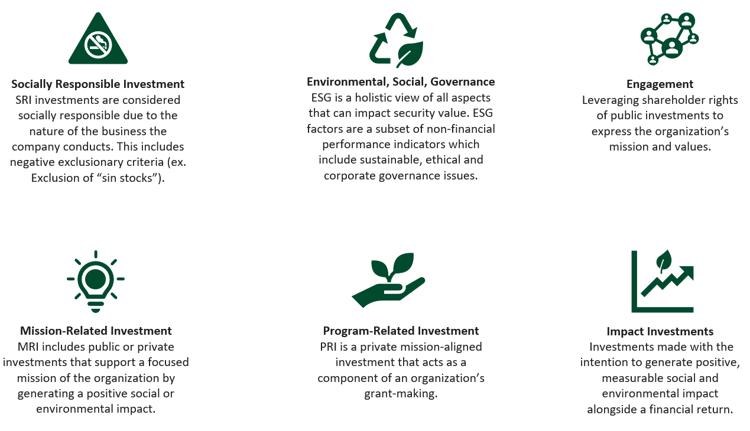

PRI is a private mission-aligned investment that acts as a component of an organization’s grant-making.

- PRI provides low-cost financing via loans or loan guarantees.

- It is a part of the Tax Reform Act of 1969.

- PRI are like grants in that the organization gives money to a charitable organization, but the expectation is that the loan will be repaid.

- Unlike a traditional investment there is low expectation of excess return.

- Commonly considered a supplement to existing grant program and eligible to count against 5% required distribution.

Examples

A private foundation provides start-up costs to a charitable organization beginning a capital campaign.

Offering financing to a private non-profit to conduct a feasibility study to explore the opportunity of constructing a solar facility. If the facility proves successful, the loan is repaid. If it is not, then the loan converts to a grant and counts against the 5% required distribution.

_with%20trademark-5.png)