Values

Aligned

Investing

We can help advance your organization's mission through responsible financial and social stewardship, through a diverse, sophisticated portfolio incorporating a value aligned strategy that is centered to your long-term objectives.

We have provided Values Aligned Investing (VAI) solutions for more than 20 years. Our team has cultivated a deep understanding of the needs of institutional clients, and we provide this service for both consulting and OCIO clients and offer VAI opportunities tailored to you.

FEG Value Add:

-

Discover your Starting Point

-

Implementation of VAI

-

Faith Based Investing

-

ESG Investing

-

Impact Investing

-

Advance your mission while balancing financial responsibility and social stewardship

We can help you identify how to begin, narrow down your options based on your needs, and guide your organization through the implementation of Values Aligned Investing (VAI). Our team can tailor a diverse and sophisticated portfolio designed to help reach your long-term objectives that your organization and community can feel good about.

Both consulting and OCIO clients can take advantage of VAI opportunities. This can be accomplished through a spectrum of investment opportunities from issue-specific screening to complete ESG criteria integrated across several asset classes.

What is Values Aligned Investing?

FEG uses VAI to encompass a range of environmental, social, governance, and impact investment strategies.

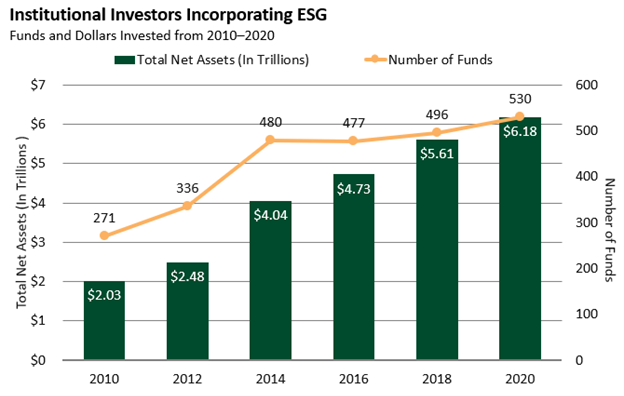

We believe VAI is becoming increasingly prevalent, with a number of implementation options as investors continue to dedicate more assets.

|

| Source: U.S. SIF. "2020 Report on US Sustainable, Responsible and Impact Investing Trends." |

Some of the most common approaches to VAI include:

-

Socially Responsible Investment: SRIs are considered socially responsible due to the nature of the business the company conducts. This includes negative exclusionary criteria (e.g., exclusion of "sin stocks").

-

Environmental, Social, Governance: ESG is a holistic screen for all aspects that can impact security value. ESG factors are a subset of non-financial performance indicators which include sustainable, ethical, and corporate governance issues.

-

Engagement: Leveraging the shareholder rights of public investments to express an organization's mission and values.

-

Mission-Related Investment: MRIs include public or private investments that support an organization’s mission by generating a positive social or environmental impact.

-

Program-Related Investment: PRIs are private, mission-aligned investments that serve as a component of an organization's grant-making.

-

Impact Investments: Investments made with the intention to generate positive and measurable social and environmental impact alongside a financial return.

The true value of VAI is in empowering your organization(s) to pair risk management with desired portfolio returns while also staying true to your values and mission. Through VAI, your institution can scale its impact and manifest change, both locally and globally.

Growing Opportunity

Investors choose VAI for several reasons: mission alignment, social benefit, fiduciary duty, returns, risk, and client demand.1 More institutions than ever are incorporating ESG criteria into their decision-making, indicating that VAI is here to stay and is on pace to make a big impact.

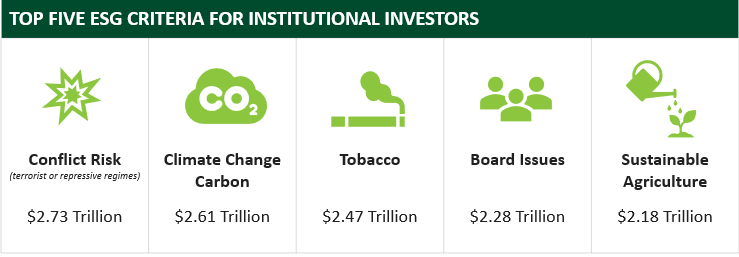

Institutions are working hard to use VAI to drive change in our world. Of the prevalent VAI focus areas, climate change and carbon emissions have been one of the most important to institutions since 2012, with more than $2.6 trillion invested in solutions.2

Data Source: Adapted from US SIF Foundations 2020 Trends Report.

1 US SIF Foundation 2018 Report. Note: Institutions cited multiple rationales, so affected number of institutions overlap.

2 US SIF Foundation 2020 Trends Report.

Intentionality and Types of Investments

Each investor’s VAI approach depends on the desired level of intentionality, from exclusionary screens on one end of the spectrum to targeted impact investments on the other end.

Investments can range from low-risk opportunities, like local loan guarantees or microfinance, to higher-returning strategies such as a for-profit venture fund.

To learn more about impact investing and ways to utilize intentionality, read the FEG Insight, Investing with the Head and the Heart.

FEG's Commitment to Values Aligned Investing

We are proud to support our clients’ desire to have their values reflected in their investment portfolios.

Our team of seasoned investment professionals is committed to understanding your unique needs and guiding you through the investing opportunities across the VAI spectrum—from issue-specific screening to complete ESG criteria integrated across asset classes.

“We are excited to help our clients implement Values Aligned Investment opportunities that align with their mission and their portfolio objectives.”

—Gary R. Price, FEG Managing Director

Our VAI Committee works closely with advisors to evaluate and implement VAI strategy to align with clients’ long-term objectives.

Disclosures

Values Aligned Investing (VAI) and all aspects of our services related to VAI are done by FEG on a best-efforts basis. Because of various limitations due to the nature of various industry-related issues, FEG cannot guarantee that VAI will align with or achieve the expected VAI values or investment returns. Further, FEG relies on third-party service providers to determine whether various investments meet the applicable VAI characterizations; thus, FEG's ability to correctly categorize the VAI exposures of such investments will depend in large part on the accuracy of the third-party service providers. There can be no assurance that third-party service providers will correctly characterize the investments. Additionally, in many cases, FEG relies on representations from its investment managers and may not have the ability to verify the accuracy of the representations due to limited transparency.