When investors consider interest rate movements, they are typically concerned with those of the 10-year U.S. Treasury. This is due primarily to its use as an indicator of broad investor confidence and its function as the “risk-free” rate investors use to value other securities. The 10-year U.S. Treasury yielded a paltry 1.54% on the last day of 2021. While 1.54% represented a low absolute starting point heading into 2022, it was still more than 100 basis points higher than the metric’s all-time low of 0.32% in March 2020 amid the most fearful financial point of the COVID-19 pandemic.

In FEG’s 2022 Fixed Income Market Outlook published in February of this year, we highlighted the asymmetrical risk facing bond investors due to the low interest rate environment. With inflationary measures climbing to start 2022 and the Federal Reserve initially behind the curve due to their presumption that inflation would be transitory, the rise in the 10-year U.S. Treasury yield had already captured investors’ attention. Since that missive, the 10-year U.S. Treasury yield rose to 4.30% on October 20 before closing the week at 4.21%, marking the highest level since July 2008, an astounding 276 basis point increase from 1.54% at the end of 2021.

Far more digestible for fixed income investors would be a meaningful increase in rates drawn out over the course of several years versus the truncated 2022 experience. It could have also been more palatable if starting yields and coupons were higher leading into the move. Higher coupons—i.e., interest income—act to soften the blow of higher interest rates, or price declines, for fixed income investors. Take 1994 for example, a year that came to be known as the “Great Bond Massacre,” when the 10-year U.S. Treasury Yield rose 193 basis points from 5.9% to reach 7.8% by year-end.

In 1994, at the beginning of the Great Bond Massacre, the starting coupon for the most well-known bellwether bond benchmark, the Bloomberg U.S. Aggregate Bond Index (BAGG), was 7.4%. The interest income generated throughout the year by the coupon acted to offset the near 10% price decline of the index that year, which moved from $107.20 to $96.50. The year-end result was a return to BAGG-oriented investors of -2.9%. Compare this with the experience witnessed thus far in 2022. The BAGG coupon was 2.4% at the beginning of the year, and the price of the index declined from $103.90 to $85.37 as of October 21, representing a 17.8% decline. Unlike 1994, the modest interest income generated by the 2.4% coupon of 2022 has not been nearly enough to offset the price decline, and the BAGG was down a whopping 16.7% year-to-date through October 21. The fixed income experience of 2022 thus far makes the Great Bond Massacre of 1994 look like a walk in the park by comparison.

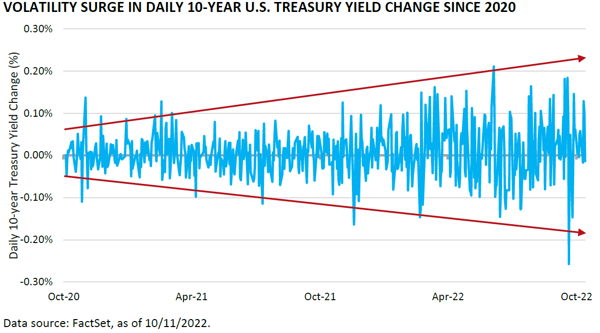

Two key elements that have driven fixed income returns lower for the BAGG in 2022 are interest rate volatility and duration—which measures a fixed income investment’s price sensitivity to interest rates. The daily 10-year U.S. Treasury yield change chart shows 2022’s surge in interest rate volatility as measured by the daily change in the 10-year U.S. Treasury yield over the past few years.

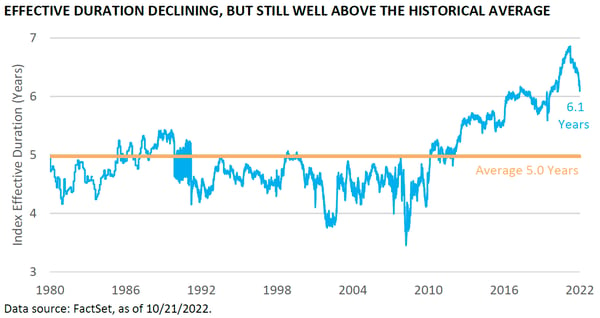

The duration of the BAGG has been a key driver of the magnitude of the decline in 2022. In addition to the higher coupon available to 1994 investors, the duration of the index was ~2 years lower (4.8 years) than it was at the end of 2021 (6.8 years). When coupled with the increase in interest rate volatility, a fixed income investment with a duration of 6.8 years could lose up to 6.8% if interest rates increase by 100 basis points (1%). The increase of 276 basis points year-to-date makes it clear why the duration of the index has had such a dramatic impact on performance in 2022, and why the experience of 1994 was much less painful by comparison. While the duration of the BAGG has declined to 6.1 years over the course of 2022, it remains well above the historical average of 5 years, suggesting interest rate volatility is likely to continue to have a meaningful impact on the future performance of the index.

Unless there is a dramatic year-end pivot by the Federal Reserve or bond market participants invest heavily in the long end of the curve, the BAGG is poised to lose approximately six times more in the present calendar year versus 1994. At least diversification worked for investors back then, as the S&P 500 Index gained 1.3% in 1994 versus 2022’s S&P 500 Index decline of 20.3% year-to-date through October 21.

Given all this, how should investors think about their experience in 2022 and what might investors in the future call 2022’s bond market rout—and for that matter, the stock market rout? FEG would like to coin the phrase “the Great Reset” to describe 2022’s market action, as the Federal Reserve remains determined to restore their credibility as an inflation fighter by raising overnight borrowing costs, using quantitative tightening to “normalize” their bloated balance sheet, and raising unemployment to reduce wage inflation.

The Great Reset comes on the heels of more than a decade of excessively easy monetary policy following the Great Financial Crisis of 2008. Indeed, while the specific factors that brought this circumstance about can be debated, it is FEG’s view that the Great Reset is primarily a result of the Federal Reserve’s complete reversal in monetary policy from ultra-easy to ultra-tight. While investors may hem and haw over the future path of interest rates, FEG believes interest rate volatility is likely to remain a key factor for investors to contend with in the future. This situation will likely persist until the Federal Reserve adjusts the current narrative—either by successfully bringing down inflation, which will allow them to reverse the rate hiking cycle or by failing and ultimately creating a more painful recession, which would potentially necessitate a return to easier monetary policy. A transition to an easier policy narrative would likely be more supportive for risk assets as well as ease interest rate volatility.

With regards to how investors should position their fixed income portfolios, FEG would like to reiterate the view expressed in the 2022 Fixed Income Market Outlook, which is that investors should continue to favor shorter duration fixed income strategies, particularly as it relates to the BAGG, where the duration of the index remains extended versus its historical average of five years. Given the Great Reset of 2022, higher quality fixed income opportunities have seen their prices decline and their yields rise, leading to attractive opportunities. What the Great Reset has not done—yet—is generate exceptionally attractive opportunities in the lower quality area of the fixed income markets, that is, high-yield bonds and bank loans. FEG continues to monitor the fixed income markets for areas of opportunity and will share further insight in our 2023 outlook.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Diversification or Asset Allocation does not assure or guarantee better performance and cannot eliminate the risk of investment loss.

Past performance is not indicative of future results.

This blog is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.